Compliance Filing

This decision sets out the AUC’s findings in approving the application from ATCO Electric Ltd. (“AE”) for disposal of its 2015-2017 Transmission deferral accounts annual filing for adjustment balances compliance filing to Decision 24375-D01-2020.

Introduction and Background

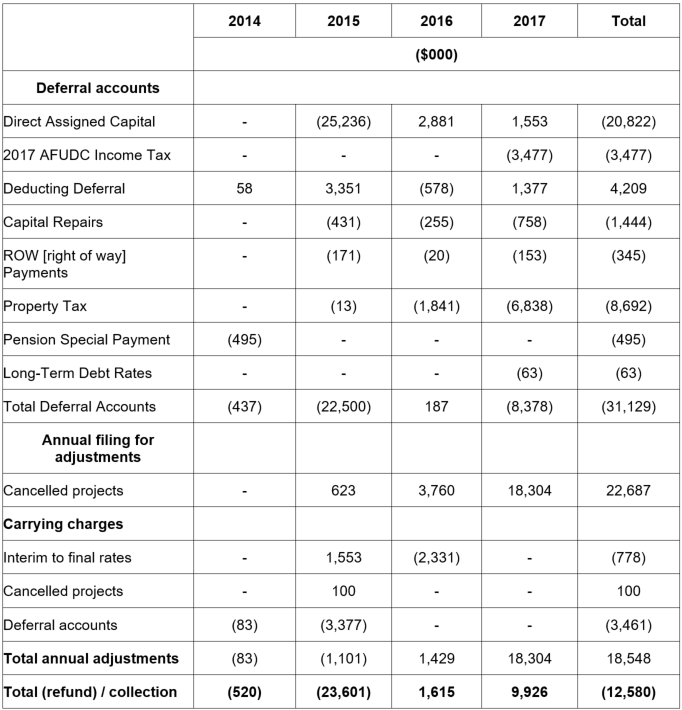

AE had requested the following adjustments to its deferral accounts and annual adjustments to be paid or (refunded) for Decision 24375-D01-2020:

Compliance with Directions from Decision 24375-D01-2020

In Decision 24375-D01-2020, the AUC had issued directions regarding AE’s calculation of carrying costs. As the AUC had approved the 2015 and 2016 final tariffs on November 21, 2017, AE had been directed to remove carrying cost for December 2017 from its calculations. AE was also directed to adjust its calculations by applying actual Bank of Canada Rates to its calculations for the period of March 2019 to November 2020. AE was also directed to make any necessary changes to the forecast settlement dated with the AESO.

AE was further directed to remove costs from its calculations. The AUC had determined that business training courses were not directly attributable to bring the assets related to those courses into operation. Costs of the training courses were accordingly disallowed. The AUC further found that AE had not made sufficient effort to recover costs of tower jacking from the contractor. In relation to the Eastern Alberta Transmission Line, invoices had been miscoded, and the AUC directed that the miscoded charges of $2,529 be removed from the project costs. As the amount of allowance for funds used during construction (“AFUDC”) had been imprudently incurred, AE was also directed to remove these costs in this compliance filing.

The AUC found that, in this compliance filing, AE had removed the necessary costs as directed and complied by the directions.

The AUC had directed AE to file supplementary information regarding incurred legal fees. Specifically related to the rates charged to AE, how these relate to the rates of other legal service providers and to the flat rate discount attributed to AE, considering the long-standing relationship AE has with Bennett Jones LLP and the volume of work directed to Bennett Jones LLP. To adjust for the differences in rates between Bennett Jones and other firms that AE had not sufficiently justified, the AUC directed that legal fees recorded at the associate level as charged to the DACDA projects for all years at issue be reduced by 20 per cent. As Bennett Jones LLP had introduced a flat rate discount on the legal fees charged in 2016 and 2017, the AUC directed that this be applied to fees incurred in 2015 as well.

The AUC found that in this compliance filing, AE had supplied enough supplementary information to comply with the directions. It noted that, for all future applications, it would be helpful if AE disclosed all costs incurred for all years included (capitalized) in the subject DACDA, broken down by year.

Finally, AE was directed to include the refund/collection calculation for the differences in 2017 AFUDC tax inputs between the forecast and actual costs as part of its settlement of deferral account balances.

AE submitted that there was an ongoing review and variance (“R&V”) proceeding regarding the calculation of AFUDC tax inputs. That proceeding could impact the AFUDC approved in Decision 24375-D01-2020. As a result, AE requested placeholder treatment for the 2017 AFUDC tax inputs. As directed, AE included the calculated refund for the differences in 2017 AFUDC tax inputs between the forecast and actual costs:

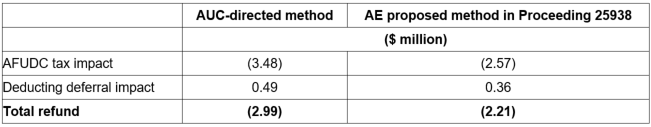

The AUC noted that an R&V application does not amend or stay previously issued directions or decisions. However, considering the impact the R&V proceeding may have on the calculations of this proceeding, the AUC would not finalize the 2017 direct assigned AFUDC tax inputs at this time and granted AE’s request for placeholder treatment of the 2017 AFUDC tax inputs pending the outcome of the R&V proceeding (Proceeding 25938). The AUC approved the refund of $2.99 million for the difference in 2017 AFUDC tax inputs.

Other Matters

AE had requested clarification on the AUC’s decisions on carrying costs related to the 2017 interim tariff, 2016 and 2017 cancelled projects, and 2016 and 2017 deferral accounts. The AUC found that it had been clear and that no clarification was needed.

AE further requested clarification of directions issued regarding future requests to recover carrying costs. The AUC responded that AE was in the best position to know when a project is cancelled and when its next filing with the AUC would occur. Therefore, and as AE is aware of the applicable rules, the AUC determined that AE is in the best position to assess the earliest opportunity to request carrying costs.

Finally, the AUC was satisfied that AE had, as directed, corrected the revised refund for the 2016 and 2017 property taxes and the operating and maintenance amount as part of revised pension special payment charges, were necessary.