AESO Tariff

In this decision, the AUC approved the application from ATCO Electric Ltd.(“AE”) for its 2019 annual transmission access charge (“TAC”) deferral account true-up and carrying costs on the true-up amounts under Rule 023: Rules Respecting Payment of Interest. The AUC approved the collection of the 2019 TAC deferral account true-up amount of $6.482 million through a Rider G.

Introduction and Background

AE applied for the net 2019 TAC deferral account true-up collection of $6.482 million from customers.

Under the provisions of the performance-based regulation (“PBR”) framework approved in Decision 2012-237, and subsequently adopted for the 2018-2022 PBR term in Decision 20414-D01-2016 (Errata), AE’s TACDA is a dollar-for-dollar flow-through of the Alberta Electric System Operator (“AESO”) tariff charges.

2019 TAC Deferral Account True-Up Amount and Rider G Rate

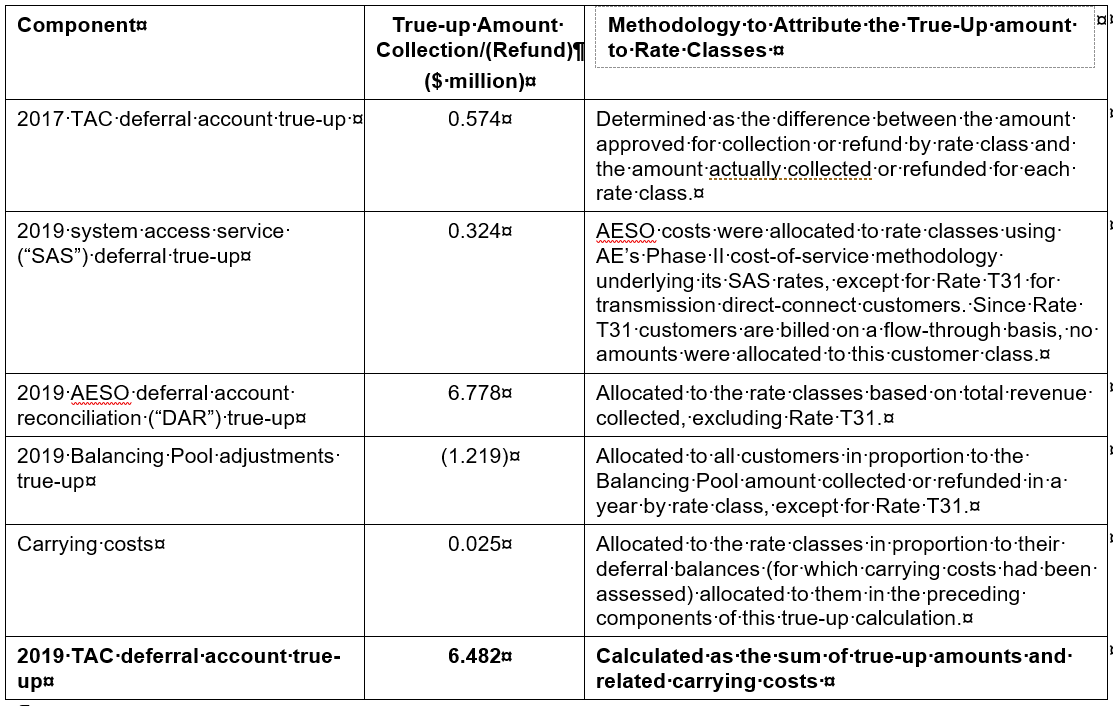

The total applied for true-up amount of $6.482 million included the following components:

AUC Findings

The AUC found the application and schedules to have been consistent with the harmonized framework approved by the AUC in Decision 3334-D01-2015 and that the amounts composing the 2019 annual TAC deferral account true-up were reasonable. The AUC further found AE’s assignment of the individual components to rate classes to have been reasonable in the circumstances and consistent with previously approved methodologies. The AUC approved the net collection of $6.482 million by AE.

As previously directed by the AUC, AE identified the under-frequency load shedding credit amounts separately and calculated carrying costs based on the weighted average Bank of Canada monthly bank rate in months in which the interest rate changed the under-frequency load. The AUC directed AE to continue this method in its next TAC deferral account true-up application.

The AUC found that AESO DAR amounts should not be included in the calculation and allocation of carrying costs if there are no carrying costs assessed on the AESO DAR amounts. AE was accordingly directed to exclude the AESO DAR amounts from the calculation and allocation of carrying costs in future TAC deferral account true-up proceedings where carrying costs would not be assessed on the AESO DAR.

Rider Implementation Period and Customer Bill Impacts

AE proposed that its 2019 annual TAC deferral account true-up Rider G be in effect from January 1, 2021, to December 31, 2021.

The AUC reviewed the total bill impacts of the proposed Rider J and noted that rate shock would be unlikely, as the typical bill changes were below the 10 per cent threshold, which had previously been used as an indicator of rate shock. The two rate classes above the 10 per cent threshold (rate classes D25 and D61 investment) were both seasonal rate classes and the bill impacts would be addressed in AE’s 2021 annual PBR rate adjustment filing, under review in Proceeding 25864.

Rider G Rate

Rider G Rates would be affected by the total true-up amount, related carrying costs, and the implementation period of the rider.

The AUC accepted AE’s proposal to calculate the Rider G Rate using the 2021 forecast billing determinants. The AUC noted that, in making this determination, it had been mindful that the 2019 rider would eventually be trued up to ensure the approved amounts were collected from, or refunded to, customers. The AUC approved AE’s Rider G per rate class, as suggested by AE, effective January 1, 2021.

Combining Annual TAC Deferral Account Applications with the Annual PBR Rate Adjustment Filings

The AUC directed AE to include its 2020 TAC deferral account true-up application and supporting materials as part of its 2022 annual PBR rate adjustment filing. As part of that proceeding, the AUC would evaluate the effectiveness of such an approach to reduce the administrative burden and enhance regulatory efficiency and would, based on its review, consider adopting it for all future TAC deferral account applications.