Rates – Compliance Filing – Regulated Rate Option Non-Energy Tariff

In this decision, the AUC considered a 2017-2020 regulated rate option (“RRO”) non-energy tariff compliance application to Decision 23752-D01-2020 from ENMAX Energy Corporation (“EEC”). The AUC found that EEC complied with the AUC’s directions in Decision 23752-D01-2020, with the exception of Direction 2 – 2017-2019 Interim-to-final rate true-up, which would be assessed in a future proceeding.

Background

In its 2017-2020 RRO non-energy tariff application, EEC had requested the following:

(a) approval of EEC’s 2017-2020 RRO Non-Energy rates (“Administration Charges”) for residential and commercial customers;

(b) a streamlined compliance process, as described in Bulletin 2016-18; and

(c) approval to implement the 2020 Administration Charges beginning the first calendar month at least ten days after AUC approval.

AUC Directions

Direction 1 – Summary and Submission of Compliance Filing by May 1, 2020

EEC filed its compliance application on May 12, 2020. The AUC found that EEC complied with this direction as modified by a deadline extension.

Direction 2 – 2017-2019 Interim-to-Final Rate True-Up

The AUC issued a direction for EEC to file reconciliation information for the true-up of 2015-2016 rates in conjunction with any rider application that may be required to true-up 2017-2019 rates.

The AUC accepted an EEC proposal to apply to true-up its 2017-2020 rates once it receives final approval of its administration charges. Accordingly, the AUC indicated it would determine EEC’s compliance with this direction in a future proceeding.

Direction 3 – Inflation

The AUC directed EEC to use the Alberta CPI [consumer price index] estimate as its non-labour inflation factor from the Fall 2019 Calgary and Region Economic Outlook, to a maximum of 2.0 per cent, as the inflation factor in determining its forecast revenue requirement for 2020.

The AUC confirmed that EEC used the appropriate labour and non-labour escalation rates of no more than 2.0 percent as the inflation factor in determining its forecast revenue requirement for 2020, as directed in Decision 23752-D01-2020 and therefore that EEC complied with this direction.

Direction 4 – Monthly Site Count Data

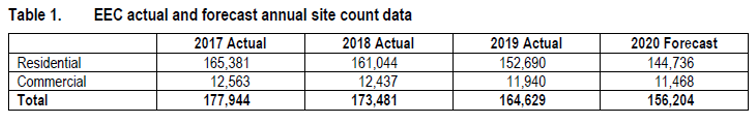

The AUC directed EEC as part of the compliance filing, to update the RRO monthly site count data for 2019 and 2020 by using actual data for all months where such data is available, and to incorporate this actual data in deriving the forecast for the remaining months.

EEC stated that it used actual site count data up to and including March 2020 to update the remaining monthly forecast site data for 2020. Annual site count data is shown in the table below:

The AUC indicated it understood that EEC ran its forecasting model, based on available actual data, as directed in Decision 23752-D01-2020. While the 2020 forecast site count was lower than previous forecasts, the AUC attributed this to EEC’s use of actual data. Based on the update to its site count forecast, the AUC found that EEC complied with this direction.

Direction 5 – Bad Debt

The AUC directed EEC in the compliance filing, to continue to use its current methodology for calculating bad debt, and to revise its bad debt forecast accordingly.

The AUC indicated it understood that EEC’s methodology for forecasting bad debt has not changed, but rather EEC made a change to the impairment methodology for accounts receivable. The AUC noted that EEC decreased its 2018 bad debt amount by $662,000, reversing the one-time increase that was applied in its original application due to International Financial Reporting Standard 9. In its original application, EEC inflated its 2019 bad debt forecast by two percent to arrive at the 2020 forecast amount. EEC continued to use this methodology in this compliance application. However, it reduced the inflation rate to 1.9 percent, which corresponded with the Alberta CPI used by EEC in this compliance application. Given the reduction to the bad debt amount in 2018, the AUC found that EEC complied with this direction.

Direction 6 – Billing and Customer Care Cost Allocation Methodology

The AUC directed EEC to use its current billing and customer care (“B&CC”) cost allocation methodology and file the resulting cost allocations and corresponding rates in the compliance filing.

The AUC found that EEC had used its current allocation methodology to allocate the B&CC costs. On that basis, the AUC considered that EEC complied with this direction.

Direction 7 – Motion for Confidential Treatment

The AUC issued the following direction:

As noted in the Commission’s findings and directions in this decision, a compliance filing for EEC’s 2017-2020 RRO Non-Energy Tariff application is required. In order for EEC to utilize the new functionality of the AUC eFiling System for the exchange of confidential documents in EEC’s compliance filing, pursuant to Bulletin 2020-05: Amendments to AUC Rule 001 to facilitate exchange of confidential documents, the Commission must grant confidentiality treatment to the information related to the compliance filing that cannot be filed on the public record. To this end, the Commission directs EEC in its compliance filing to submit a motion for confidential treatment of information.

EEC filed a letter with the AUC on April 21, 2020, requesting that the AUC extend the confidentiality treatment originally granted in Proceeding 23752 to this compliance filing proceeding. In response to EEC’s letter, the AUC issued a ruling in Proceeding 25523, on April 24, 2020. In the ruling, the AUC extended the confidential treatment to certain documents in EEC’s 2017-2020 RRO non-energy application to this compliance filing. On this basis, the AUC considered that EEC had complied with this direction.

Direction 8 – Listing of Confidential Documents

The AUC issued the following direction:

In addition, the Commission considers it would be efficient if all EEC confidential documents filed on the record of this proceeding were migrated to the compliance filing. In its motion under Section 28 of Rule 001, the Commission directs EEC to provide a list of its confidential documents filed in this proceeding (with the previous public document or the public placeholder for the confidential document clearly identified in the format of Exhibit 23752-X0000). In addition, the list must identify any new documentation that will require confidential treatment in the proceeding for the compliance filing.

The AUC noted that EEC provided a list of the confidential documents filed in Proceeding 23752. In addition, EEC filed Exhibit 25551-X0007-Confidential, which contained the confidential documents filed in Proceeding 23752. The AUC found that EEC complied with this direction.

Requested Approvals

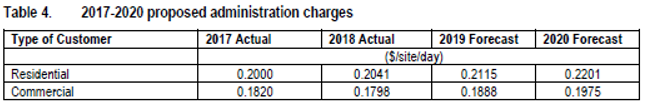

EEC requested approval of the following proposed administration charges:

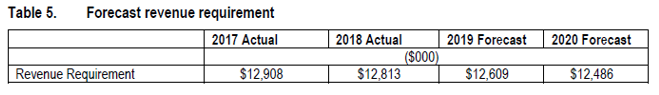

EEC indicated that the proposed administration charges were calculated based on the RRO site count in Table 1 of this decision and the following forecast revenue requirement:

The AUC found that EEC complied with the AUC directions from Decision 23752-D01-2020, with the exception of Direction 2 – 2017-2019 Interim-to-final rate true-up, which would be assessed in a future proceeding. The AUC indicated it had also reviewed the forecast revenue requirement and RRO site count. The AUC was satisfied that the 2017-2020 proposed administration charges were calculated using the forecast revenue requirement and RRO site count, and found that the proposed administration charges would result in just and reasonable rates. On this basis, the AUC approved EEC’s 2017-2020 administration charges, as shown in Table 4.

The AUC directed EEC to implement its 2020 administration charges beginning the first calendar month at least 10 days after AUC approval of these rates. Based on the issue date of this decision, the AUC noted that these rates would be effective August 1, 2020.