Performance-Based Regulation Rate Adjustment

EPCOR Distribution & Transmission Inc. (“EDTI”) filed its 2016 annual performance-based regulation (“PBR”) rate adjustment filing, and requested approval of its distribution access service (“DAS”) rates and changes to its terms and conditions of service, effective January 1, 2016 on an interim basis.

The PBR framework, as described by the AUC, provides a formula mechanism for the annual adjustment of rates over a five year term. In general, the companies’ rates are adjusted annually by means of an indexing mechanism that tracks the rate of inflation (“I Factor”) relevant to the prices of inputs less an offset (“X Factor”) to reflect productivity improvements that the companies can be expected to achieve during the PBR plan period. The resultant I-X mechanism breaks the linkages of a utility’s revenues and costs in a traditional cost-of-service model. The PBR framework allows a company to manage its business with the revenues provided for in the indexing mechanism and is intended to create efficiency incentives similar to those in competitive markets.

However, certain items may be adjusted for necessary capital expenditures (“K Factor”), flow through costs (“Y Factor”), or material exogenous events for which the company has no other reasonable cost control or recovery mechanism in its PBR plan (“Z Factor”). EDTI did not apply for a Z Factor adjustment.

EDTI’s PBR rates were originally approved in Decision 2012-237, Decision 2013-462 and Decision 2014-346.

2016 Updates to I Factor and I-X Mechanism

As part of EDTI’s submissions, it filed an update to its I Factor of 2.06 percent based on data vector v79311387 from Statistics Canada Table 281-0063 to calculate Alberta average weekly earnings figures, as the previous Statistics Canada tables had been terminated. Together with EDTI’s X Factor of 1.16 percent approved in Decision 2012-237, EDTI requested approval of its I-X index value of 0.90 percent for 2016.

With the exception of the escalation of costs under the I-X mechanism, EDTI proposed no other changes to its terms and conditions of service.

No parties objected to EDTI’s updated calculations, and the AUC approved EDTI’s 2016 I Factor and resulting I-X mechanism for 2016 as filed, finding the calculations to be reasonable.

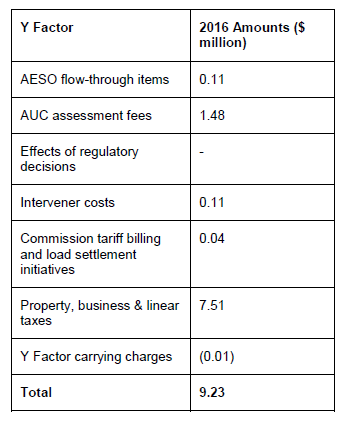

Y Factor

EDTI requested the following 2016 Y Factor amounts:

EDTI submitted that it was unable to forecast on a reasonable basis, the costs associated with AUC tariff billing and load settlement initiatives or effects of regulatory decisions. Amounts applied for by EDTI in respect of these accounts were true-up costs for 2014 and 2015.

EDTI noted that it’s requested 2016 Y Factor costs included, for the first time, capitalized incentive pay costs. However, it noted that the increased costs were less than $50, and were therefore immaterial.

After review, the AUC determined that EDTI’s requested Y Factor amounts for 2016 were properly calculated and adequately supported. The AUC also agreed with EDTI’s submission that the additional incentive pay costs were immaterial. Accordingly, the AUC approved EDTI’s 2016 Y Factor amounts for these costs as filed, totalling $9.23 million.

K Factor Placeholder

EDTI requested a K Factor placeholder in the amount of $24.81 million for 2016, which is equal to 90 percent of its requested $27.57 million for EDTI’s 2016-2017 forecast PBR capital tracker application.

No party objected to EDTI’s application of a 90 percent placeholder for its 2016 K Factor.

The AUC approved EDTI’s 90 percent proposed K Factor placeholder as filed, noting that the forecast placeholder provides a reasonable level of funding and reduces the potential for customer rate shock in future proceedings.

2016 Billing Determinants and Rate Riders

EDTI submitted that it made no changes to the methods used to calculate its forecast billing determinants, which were based on short-run forecasting (as previously approved in Decision 2014-346). There were no objections to EDTI’s proposed 2016 billing determinants.

EDTI submitted that the variances between forecast and actual billings for 2013 and 2014, that were larger than 5 percent, were caused by higher than historical energy consumption, errors in forecast calculations for the traffic light rate class, and the implementation of light-emitting diode (or LED) lamps for the lane lights rate class.

The AUC approved EDTI’s proposed 2016 billing determinants as filed. The AUC directed EDTI to provide information concerning any variances from forecast to actual by rate class, and to identify the causes of variances in billing determinants that exceed ± 5 percent in its next PBR filing.

EDTI proposed to continue collection of the following four distribution riders:

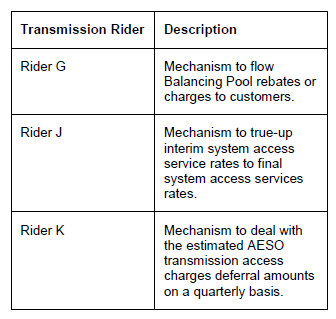

EDTI also proposed to continue collection of the following three transmission riders:

While EDTI noted that it did not require a rider DG and DJ, it submitted that these riders could be addressed as a component of the annual PBR rate filing rather than through the use of riders. EDTI submitted that such an approach could reduce the regulatory burden and improve rate stability. However, since rate increases may be limited, EDTI stated that it would be helpful to continue its application as a rider to true-up material differences on a more timely basis.

No party objected to EDTI’s continued use of its rate riders.

The AUC held that the transmission and distribution riders were necessary to address flow-through or AUC directed items such as Y Factors, and thereby approved the riders as applied for by EDTI.

Financial Reporting Requirements

As directed by the AUC in Decision 2012-237, EDTI submitted a copy of its Rule 005: Annual Reporting Requirements of Financial and Operational Results (“Rule 005”) filing, which included, among other items, the equity thickness, return on equity figures and a confirmation that the assumptions and calculations in the application were accurate and complete.

The AUC determined that EDTI’s Rule 005 filing was compliant with its direction in Decision 2012-237. However, the AUC noted that the Rule 005 filing disclosed two changes relating to the allocation of incentive pay and changes to meter depreciation. As the AUC found that these matters were being considered in Proceeding 20407, it declined to rule on those specific changes.

Rates and Bill Impacts

EDTI proposed to update customer specific (“CS”) rates CS39, CS40, and proposed a new rate, CS41.

With respect to CS40, EDTI submitted that the CS40 rate class was previously approved in Decision 2014-346. EDTI submitted that the CS39 and CS40 rates were calculated on a weighted average cost of capital (“WACC”) rate of 6.99, using the interim return on equity of 8.75 percent for 2014. EDTI proposed to update CS39 and CS40 calculations by applying a WACC rate of 6.50 percent pursuant to the AUC’s directions in Decision 2191-D01-2015. EDTI submitted that this resulted in a refund of $3,090 to the CS39 rates, and a refund of $3,281 to the CS40 rates for 2014 and 2015.

With respect to CS41, EDTI sought approval for a new CS rate, as the customers’ demand exceeded the 5,000 kilowatt-ampere (kVA) maximum for the time of use primary (or TOUP) class. EDTI submitted that the CS41 rate would be calculated using a method identical to all other CS rate classes.

The AUC held that the calculations for CS39, CS40 and CS41 were reasonable and consistent with previously approved methodologies. Accordingly the AUC approved the proposed changes to CS39 and CS40, and approved the new CS41 rate.

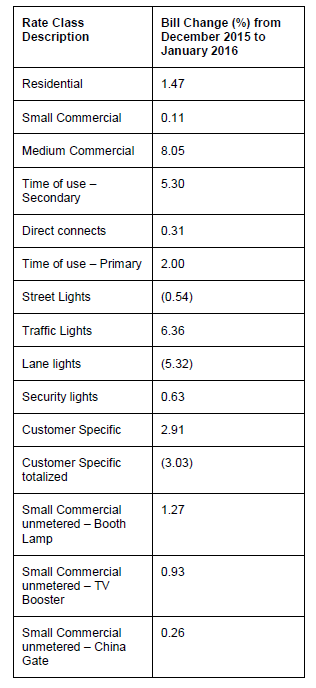

EDTI submitted that the bill impacts for its proposed 2016 rates would be as follows:

The AUC held that while it considers 10 percent to be a threshold that is indicative of rate shock, the AUC found that the bill impacts for all customer classes would be below 10 percent. The AUC determined that the bill impacts would therefore not cause rate shock to consumers.

The AUC noted that the 2016 rates reflect the inclusion of a 90 percent K Factor placeholder, and that rates are interim until approved on a final basis by the AUC.

As a result of the above findings, the AUC ordered that the distribution rates and special charges contained in Appendix 4 and Appendix 5 of this decision be approved on an interim basis effective January 1, 2016.

Terms and Conditions

EDTI proposed mostly minor changes to its terms and conditions, but also included a revision distribution connection service which reflected the implementation of the Advanced Metering Infrastructure (“AMI” or smart metering) fees. EDTI proposed the ability for EDTI to install an AMI meter at a site where a customer has previously opted out once that customer discontinues service. EDTI also proposed to include a non-standard meter reading fee and non-standard meter installation fee for those consumers who do opt-out of the AMI program.

No party expressed concern with EDTI’s proposed changes to its terms and conditions.

The AUC held that, given the AUC’s prior approval of the AMI program in capital tracker proceedings, EDTI’s proposed changes were reasonable and approved the changes as filed, effective January 1, 2016.

Accordingly, the AUC ordered that EDTI’s 2016 distribution access service tariff, as well as its terms and conditions, be approved on an interim basis as set out in Appendix 6 to the decision, effective January 1, 2016.