Facilities – New Fee Methodology

On April 11, 2022, the AER announced the first set of administration fees calculated under the new methodology authorized by the Government of Alberta (“GoA”) in 2019. Under this new methodology, the levy includes pipelines and facilities.

For 2022/23, the GoA approved a revenue requirement of $200.7 million as necessary for the AER to support its operations.

The administration fees are divided by sector, as follows:

The AER noted that the amount of each 2022 invoice was determined with reference to the AER’s revenue requirement, 2021 production volumes, the number and types of wells and schemes, the total length of pipelines on each class, facility inlet rates, and the number of operators in the sector.

Oil and Gas Sector

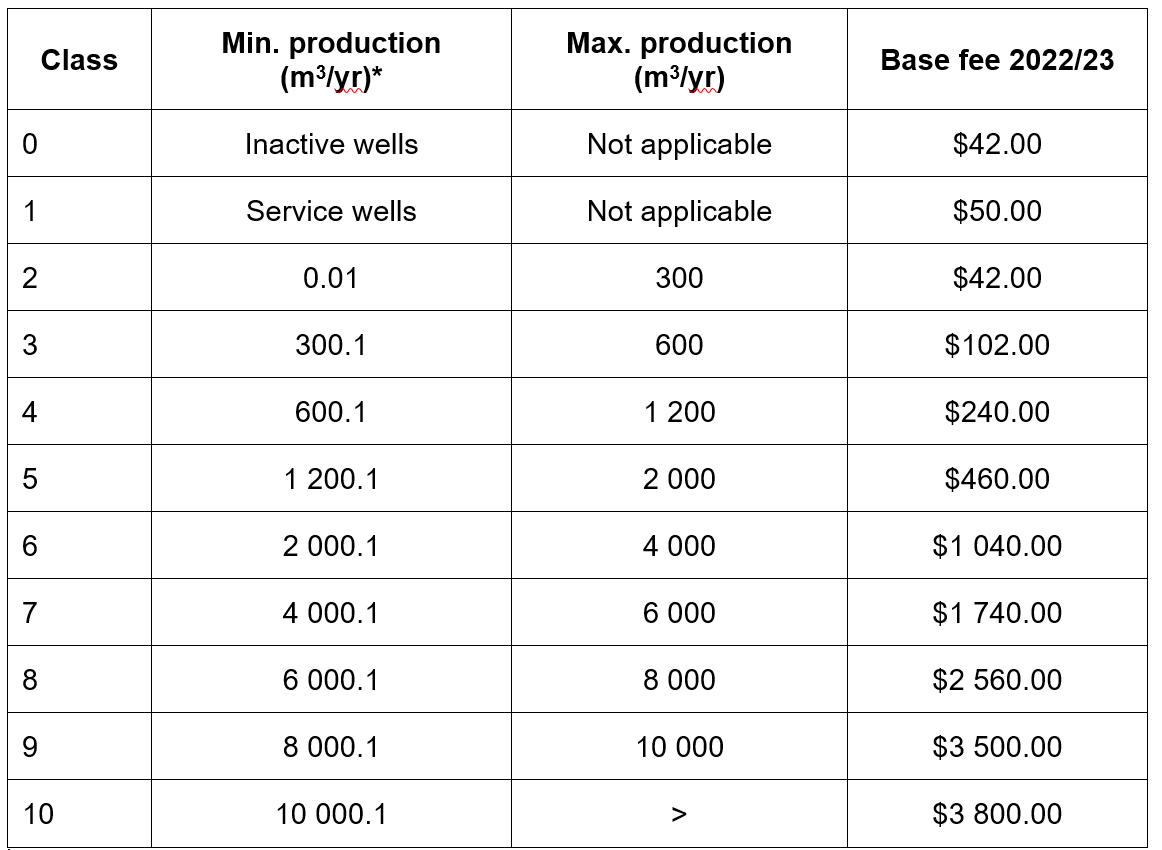

The administration fee in the conventional oil and gas sector is based on individual well production of oil and bitumen or gas and the number of inactive, service, and production wells for the year ended December 31, 2021.

All wells are classified into one of the ten following base fee classes set out in the Alberta Energy Regulator Administration Fees Rules (“AFR”).

Alberta Upstream Petroleum Research Fund

The AER was requested to make use of its administration fee process to collect $4 100 000 to fund the Alberta Upstream Petroleum Research Fund (“AUPRF”) in 2022. The AER has agreed to assist and has included an amount for this funding in the oil and gas well administration fee invoices. As a result, the adjustment factor used for invoicing has increased from 3.721143 to 3.827589. The AER is not involved in and does not make any decisions regarding how these funds are spent or to whom the funds are disbursed. Payment of the AUPRF is voluntary.

Oil Sands Sector

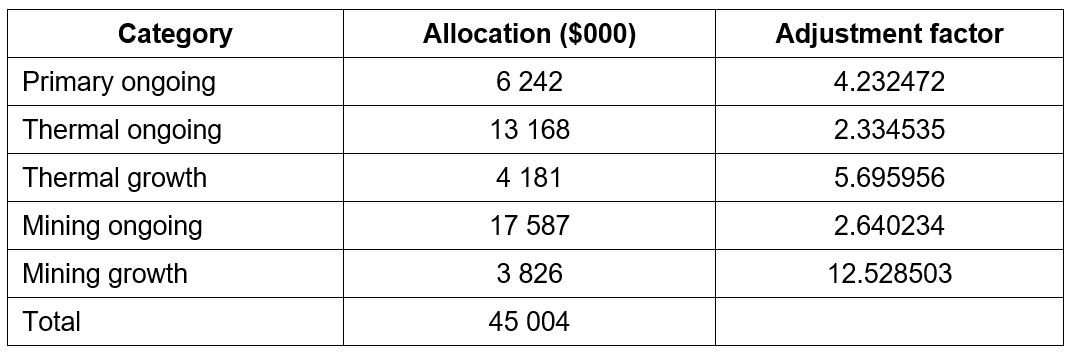

As shown in the table below, fees for the oil sands sector are levied in five categories based on operating information for the 2021 calendar year.

Coal Sector

The administration fee for coal is based on the mine’s share of total production volumes for the previous year. As specified in the AFR, the fee is set at $0.861248 per tonne of coal.

Pipelines Sector

Pipeline segments subject to an administration fee are separated into the following classes, and an adjustment factor of 0.586598 is applied to each base fee. The adjustment factor ensures that the total administration fee collected for the sector satisfies the AER’s revenue requirement.

Facilities (Directive 056) – Gas Plants

The administration fees are levied to gas plant facilities with an inlet rate of at least ten million cubic meters per day as of December 31, 2021, and an active, new, or unknown activity status. The rate is set at $2.044546 for every thousand cubic meters per day and applied based on the individual facility inlet rate, as specified in the AFR.

Facilities (Directive 023) – Processing Plants

The administration fees are levied to processing plant facilities approved under the Oil Sands Conservation Act with an operating status as of December 31, 2021. The rate is set at $3.071925 for each cubic meter per day and applied based on the individual facility inlet rate as specified in the AFR.