Rates

This decision set the rates for Salt Box Coulee Water Supply Company Ltd. (“Salt Box”) for water services to its customers. The AUC finalized the interim rates previously set in October 2017, with interim rates for customers remaining unchanged until July 31, 2020. Effective August 1, 2020, the AUC approved final rates for Salt Box’s distribution and co-operative customers. The increase was required to provide sufficient operating funds to ensure safe and adequate service at just and reasonable rates. In considering future changes to rates by Salt Box, the AUC will require audited financial statements as directed in prior rulings and this decision.

Introduction and Background

In Decision 21908-D01-2017, the AUC approved interim rates for Salt Box and directed Salt Box to file an application for approval of final rates by July 31, 2018. After several deadline extensions, Salt Box filed its application for final rates on February 12, 2019. The AUC issued a notice of application on February 19, 2019. Submissions were received from multiple Salt Box customers.

Based on its preliminary review of the application, the AUC identified three deficiencies in the application and issued a ruling dated April 18, 2019. In the ruling, the AUC addressed the application deficiencies, including the need for audited financial statements for 2015, 2016, and 2017, confirmation of the final cost for an ultraviolet (“UV”) light disinfection system upgrade and financing details for the UV system.

Following Salt Box’s response to customer submissions, which included concerns regarding the cost of auditing three years of financial statements, the AUC issued a ruling on August 6, 2019, relieving Salt Box of the requirement to provide three years of audited financial statements. Instead, the AUC directed Salt Box to provide audited financial statements for 2018. The AUC ruled that the cost of the audit would be recovered from customers and directed Salt Box to proceed immediately with obtaining audited financial statements for 2018.

The AUC issued a ruling regarding the UV system upgrade and rate rider on November 1, 2019. On December 16, 2019, the AUC issued Decision 24295-D01-20197 approving rate rider amounts effective January 1, 2020, to recover the costs associated with financing, construction, and commissioning of the UV system upgrade.

In a process letter dated January 28, 2020, the AUC advised that it would provide AUC staff to perform certain accounting verification and reconciliation procedures with respect to the financial records and supporting documents of Salt Box for 2017, 2018, and 2019.

The AUC requested Salt Box to provide its consent to the accounting and verification procedures prior to commencing this process, allowing the AUC to review Salt Box’s financial records for 2017, 2018, and 2019. Salt Box provided consent on February 11, 2020, however, its consent was conditional. It stated that the 2017-2019 financial statements had not been completed, and additional time would be required to prepare these statements. Data for 2019 would not be available for some time. Further, extending the accounting verification to years other than 2018 would be burdensome, and the delay would be unacceptable to Salt Box as its costs of running the utility were not being covered.

Given these constraints, the AUC considered it was untenable to delay a determination on final rates while awaiting Salt Box to complete its financial statements. The AUC determined that it would follow the process used to determine interim rates in Proceeding 21908 and proceed with setting final rates for the utility.

Compliance with Decision 21908-D01-2017

In Decision 21908-D01-2017, the AUC issued ten directions to Salt Box, seven of which were related to this application or future rate applications. The AUC found Salt Box complied with six of the directions involving support for electricity and natural gas expenses; the application of interim rates; UV system financing; filing of a final rate application; filing of proposed terms and conditions (“T&Cs”) for service; and advising the AUC of regarding the status of customers. It required Salt Box to provide further information in its next rate application for four directions, including provisions of actual expense amounts for water treatment; maintenance plan information; support for administration expenses; and audited financial statements, upgrade plans, and affiliate services.

Position of the Parties Participating in the Proceeding

The AUC noted that the submissions raised by parties to the proceeding related to certain key issues and remedies. Given the statutory framework and the AUC’s oversight of public utilities, the AUC noted that it would only determine the issues and remedies that come within its rate-setting jurisdiction, including the T&Cs of Salt Box, keeping in mind the safe and adequate supply of water to customers.

Revenue Requirement

In its application, Salt Box requested a revenue requirement of $248,969 for 2019. Salt Box also included in its application forecasts for 2017 and 2018. Due to the complexity of the proceeding and the number of filings on the record, Salt Box’s rates were not set for 2019, and therefore, 2019 rates were subject to the interim order in Decision 21908-D01-2017.

The AUC approved forecast operator services expenses of $58,507 per year, allocated to operator services and repairs and maintenance; $26,002 in maintenance and repair expenses, consisting of $14,627 from the 25 percent allocation for operator services; $10,175 for inspections and $1,200 in miscellaneous repair expenses; forecast chemical expense of $2,500; $7,220 for water testing; $11,397 for utility expenses; $7,183 for insurance; $2,000 for accounting expenses; and $1300 for banking fees and office expenses. The AUC did not approve requested amounts for vehicles, rent, legal fees, or forecast amounts for return and depreciation. It also took steps to reduce amounts requested for other items and addressed some items requested under a section of the decision on affiliate transactions.

Affiliate Transactions

The AUC noted that affiliate transactions could be a single transaction or a series of transactions between related companies or parties. Without proper standards and parameters to guard against inappropriate affiliate conduct, preferences, or advantages, customers of a regulated business may be adversely impacted.

In considering affiliate transactions, the AUC noted that in its application, Salt Box identified that amounts to CWM Services were paid to Mr. Jeff Colvin. Regional GP Enterprises Inc. was identified as a related party in Proceeding 21908, with Mr. Jeff Colvin having signing authority for Regional GP Enterprises, and also being a director of Salt Box.

The AUC noted that Salt Box requested an amount of $70,080 be paid to affiliates for salaries and wages, vehicle, and rent. In circumstances where a utility does not have a sufficient rate base on which to earn a reasonable return, the AUC noted it may award a management fee in lieu of these amounts. In this case, the AUC considered that a management fee would be a reasonable substitute for the costs associated with affiliate transactions, and approved a management fee of $36,000 per year to be included in revenue requirement.

Approved Revenue Requirement

The AUC awarded $137,482 for the forecast and approved revenue requirement, a reduction of $111,487.08 of the amount requested by Salt Box in its application.

Capital Projects

Salt Box requested approval of at least $82,000 for forecast capital projects, consisting of approximately $20,000 for a master meter for Windmill; $45,144 for residential meters; and $17,824 for fencing. Salt Box also considered new river raw water pumps and a power generator were required.

Due to the lack of audited financial statements, the AUC noted that it did not have a clear understanding of Salt Box’s rate base and the impact of these capital projects on rates. The AUC also noted uncertainty on how Salt Box would finance these capital projects, and a lack of information to support its proposed capital projects. The AUC denied these capital project requests at this time, but Salt Box is not precluded from applying for capital projects in a future general rate application.

Audited Financial Statements

The AUC outlined issues related to its directions to Salt Box to provide audited financial statements. A financial audit had not yet been undertaken, and the AUC had attempted to undertake an accounting verification and reconciliation process to confirm Salt Box’s financial information for the years 2017, 2018 and 2019. While Salt Box consented to this, its consent was conditional, as it noted that 2017-2019 financial statements had not been completed and additional time would be needed and that 2019 information would not be available for some time.

The AUC noted that the provision of audited financial statements had been a source of contention between Salt Box and customers. The AUC maintained that an audit covering Salt Box’s most recent financial year should be completed, and the cost of the audit should be borne by customers. Further, completing an audit will establish a financial baseline for future rate applications. On this basis, the AUC directed Salt Box to provide the AUC and interveners with audited financial statements for its most recent fiscal year, which will be 2020, by November 1, 2021, as a post-disposition document. It approved the amount of $15,000 for audited financial statements to be collected as part of Salt Box’s final approved rates and established a rate rider to collect this amount over 12 months. The AUC emphasized that no further rate applications will be considered until audited financial statements are submitted.

UV Upgrade

Salt Box did not notify the AUC of any changes to the financing related to the UV system upgrade or any other changes that would impact the AUC’s approval of the rate rider in Decision 24295-D01-2019.

Terms and Conditions

The AUC noted that Salt Box provided services to some customers directly, but that other residents are provided water through two cooperatives that purchase water from Salt Box and distribute it to their members using their distribution lines. The AUC considered that customers of these distribution systems should not be governed by the T&Cs of Salt Box but rather by each co-operative’s respective terms and conditions.

The AUC approved certain additional T&Cs for water service to one of the cooperatives, which had a water services agreement (“WSA”) with Salt Box. No evidence was provided of a WSA with the second co-operative, and the AUC directed Salt Box to (1) identify a valid WSA that may have provisions that could act as T&Cs for the second co-operative and file the valid WSA with the AUC, or (2) file a separate set of T&Cs that are proposed to apply to the second co-operative if a valid WSA is not available.

Review of the Proposed Terms and Conditions of Service Filed by Salt Box and the Water Task Force

Having established that there is a separate set of T&Cs for the two cooperatives, the AUC addressed the proposed T&Cs for other customers, as filed by Salt Box and a Water Task Force representing the cooperatives and two communities served by Salt Box. The AUC found that the proposed T&Cs filed by the Water Task Force were more comprehensive than the proposed T&Cs filed by Salt Box. Other than the changes to T&Cs filed by the Water Task Force that were specifically rejected by the AUC in the decision, the AUC approved the T&Cs filed by the Water Task Force as the T&Cs that shall govern the relationship between Salt Box and customers in the two communities not governed by cooperatives, effective August 1, 2020.

Allocation of Costs and Rate Design

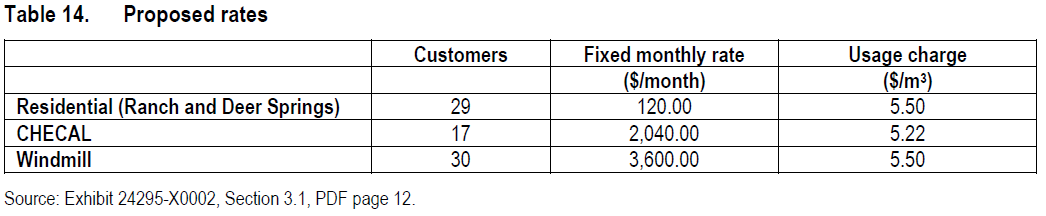

In its application, Salt Box proposed the following rates:

Salt Box argued that its fixed fee was not high enough and a greater proportion of its rates should be fixed. Given that water is the main asset to a home, the availability of water supply should be a primary charge. Salt Box noted that it had numerous customers paying under $40 a month for water.

The AUC noted that it was not opposed to Salt Box’s proposal to set the fixed monthly fee at $120 per month. Setting the fixed monthly fee at $120 per month will provide greater revenue stability to Salt Box and will also minimize monthly billing fluctuations for residential customers. Given Salt Box’s need for revenue stability and customer certainty in their monthly bills, the AUC considered this to be a reasonable fixed fee amount. The AUC also approved a variable rate water charge of $1.62/m3 on water consumption.

Approved Rates for 2020 and Reconciliation of Interim Rates

The AUC held that the interim rates approved in Decision 21908-D01-2017 were final rates from November 1, 2017, up to and including July 31, 2020, and approved the water rates noted above from August 1, 2020. With rate riders, the AUC noted that the average residential customer at a site consuming 21.59 m3 per month would be $229.87.