Rates – Compliance Filing – General Tariff Application

In this decision, the AUC considered an application from the City of Lethbridge’s electric utility (“Lethbridge”) requesting approval of its compliance filing to Decision 24847-D01-2020, which was Lethbridge’s 2018-2020 transmission facility owner (“TFO”) general tariff application (“GTA”). The AUC was satisfied that Lethbridge’s compliance filing adequately addressed and responded to its directions in Decision 24847-D01-2020.

Compliance with the AUC’s Directions from Decision 24847-D01-2020

On April 6, 2020, the AUC issued Decision 24847-D01-2020, which considered Lethbridge’s 2018-2020 TFO GTA. In that decision, the AUC denied Lethbridge’s requested revenue requirement regarding proposed 2020 escalation rates for “other” and “contractor” categories, a proposal to apply a direct assigned deferral account surplus to a hearing cost reserve account deficit, and certain depreciation expense related calculations.

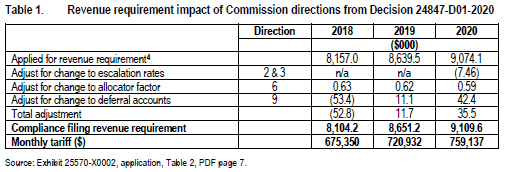

In compliance with directions 1, 2, 3, 6 and 9, from Decision 24847-D01-2020, Lethbridge revised its 2018-2020 forecast revenue requirement and monthly tariff to the following amounts:

The AUC indicated it was satisfied that Lethbridge’s compliance filing adequately addressed and responded to its directions from Decision 24847-D01-2020. The AUC noted, however, that there were remaining directions (Direction4 which required discussion and support of allocation methodology; Direction 5 which requires the use of AUC-approved depreciation parameters for determining forecast depreciation expense; and Direction 7 which requires the implementation of group depreciation practices for capital and depreciation related accounting transactions), intended for the next or all future GTAs. The AUC also noted Direction 8, which requires a technical workshop with intervening parties three-to-six months prior to the filing of the next GTA would also remain outstanding.

The AUC considered Lethbridge’s response to Direction 10 in more detail, as set out below.

Direction 10 from Decision 24847-D01-2020

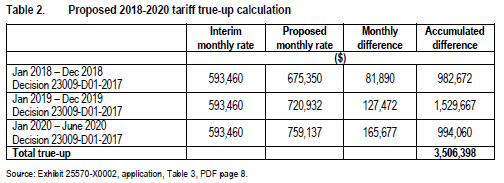

As per the AUC’s instructions in Direction 10, Lethbridge calculated the required January 2018 through June 2020 true-up amount and the new monthly tariff effective July 2020, as shown in the table below:

Lethbridge calculated its monthly tariff to be charged to the Alberta Electric System Operator for the use of the Lethbridge’s transmission facilities for 2018-2020 based on Lethbridge’s revenue requirement shown in Table 1. Lethbridge proposed to collect from the AESO it’s January 2018 to June 2020 revenue shortfall between its interim monthly tariffs and approved tariffs by way of a one-time charge of $3,506,398. Effective July 1, 2020, Lethbridge would implement its 2020 monthly tariff in the amount of $759,137.

The AUC found that the annual tariff and monthly rates for the 2018-2020 test years corresponded to the respective revenue requirements and approved them on a final basis. The AUC also approved a one-time charge of $3,506,398 to be collected from the AESO for the revenue shortfall resulting from the difference between Lethbridge’s interim and approved monthly tariffs between January 1, 2018, and June 30, 2020.