General Rate Application – Depreciation Study – Urban Pipeline Replacement Program

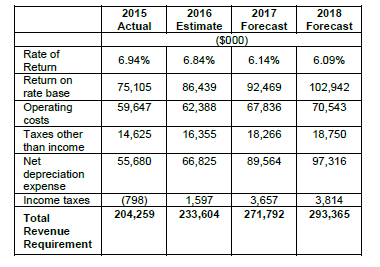

In this decision, the AUC considered ATCO Pipelines (“ATCO”) 2017-2018 revenue requirement application (the “Application”). In the Application, ATCO requested the AUC approve its 2017-2018 forecasted revenue requirements, in the amounts shown in the table below:

AUC Findings re ATCO IR Responses

The AUC found that ATCO’s level of responsiveness in IR responses to be of concern and that ATCO did not respond to some questions in a manner that fulfilled the AUC’s expectations for record development and contributing to a better understanding of the issues.

Rate Base

Forecast Accuracy

With respect to concerns regarding ATCO’s forecasting accuracy raised by the UCA, the AUC found that:

(a) including capital subject to deferral account treatment when forecast accuracy artificially inflates the variance between actual and approved while discounting the fact that some capital expenditures, such as UPR costs, are not forecastable and subject to uncertainty; and

(b) ATCO’s non-deferral account expenditures exceeded approved amounts in 2015 and 2016, resulting in ATCO earning a lower return on rate base from higher actual forecast expenditure.

Capital Expenditures

ATCO submitted that the forecast improvement and replacement capital expenditures were required for pipeline and facility integrity related initiatives, including in-line inspection (“ILI”).

The AUC approved ATCO’s forecast ILI capital expenditures because the inspections were a proactive initiative designed to detect areas of the pipeline susceptible to future defects in transmission pipeline.

Discontinuance of NGTL Integration Deferral Account

The NGTL integration deferral account was established to capture the difference between forecast and actual costs associated with integration with NGTL. The AUC noted that the deferral account was originally approved under the criteria for new deferral accounts set out in Decision 2003-100 of materiality, uncertainty in cost forecasts, factors beyond the utility’s control and risk to the utility, while ensuring costs and benefits are symmetrically applied to the utility and customers.

ATCO requested to discontinue and settle the NGTL integration deferral account.

The AUC approved the request, based on its finding that:

(a) integration and the associated asset swap was completed in 2016;

(b) the criteria for a deferral account were no longer met; and

(c) ATCO’s request to discontinue and settle the NGTL integration deferral account was reasonable and necessary.

Based on its review of the inputs and calculations of the NGTL integration deferral account, the AUC approved ATCO’s one-time settlement amount of $7,072,000 as filed.

Operating Costs

The AUC found that the across-the-board reduction recommended by UCA did not have any bearing to what ATCO actually required to safely and reliably operate its system.

The AUC directed adjustments to specific elements of ATCO’s O&M forecasts, including:

(a) Out-of-scope Labour: The AUC found that an out-of-scope labour escalation rate of 0.5 percent for 2017 and 1.0 percent for 2018 was reflective of the current market and based on the best information available on the record of the proceeding. This reflected a reduction from ATCO’s requested escalation rates of 1.0 percent for 2017 and 2.5 percent for 2018;

(b) Pension Costs: In Decision 21831-D01-2017, the AUC found that ATCO’s applied-for increase in the amount of pension cost of living allowance (“COLA”) recoverable in rates was not warranted. Based on its findings in Decision 21831-D01-2017, the AUC denied the placeholders for a COLA adjustment from 50 percent to 100 percent, as requested by ATCO. The AUC directed ATCO to incorporate the findings of Decision 21831-D01-2017 for all pension costs and COLA into its compliance filing to this decision;

(c) O&M Supplies Expenses: ATCO forecasted utilities, company vehicles, travel, accommodation, and meals costs to increase at the rate of inflation. ATCO forecasted an increase for materials, equipment and tools costs based on inflation and current market pricing for items affected by commodities. ATCO assumed inflation rates of 2.6 percent and 2.3 percent for supplies in 2017 and 2018, respectively. The forecast inflation rate was based on the Alberta CPI published in May 2016 by the Conference Board of Canada. The AUC noted that ATCO had provided updated CPI forecasts in response to IRs, but that it did not update its application as it considered its forecasts as provided in the application to be reasonable; and

(d) IT Costs: The AUC approved ATCO’s forecast O&M IT volumes, subject to any adjustments required due to directions elsewhere in this decision. The AUC noted that Proceeding 20514 regarding ATCO IT common matters was ongoing. The AUC found that given the total forecast IT costs were calculated from the forecast IT volumes and the negotiated IT pricing, total IT costs were to be treated as placeholders in this proceeding, pending a determination in Proceeding 20514 with respect to pricing.

Return on Capital

ATCO requested a return on equity (“ROE”) of 8.50 percent for 2017 and a capital structure of 37 percent equity and 63 percent debt for 2017, as per the AUC’s determinations in the 2016 General Cost of Capital decision.

The AUC found that ATCO prepared its debt rate forecasts using a method consistent with what was approved in Decision 3577-D01-2016. The AUC tested and approved this methodology during ATCO Pipelines’ 2015-2016 GRA. Consistent with its findings elsewhere in this decision regarding use of the most recent information, the AUC found that the most current Consensus Forecast data on the record of this proceeding should be used when determining what debt rate to use. Therefore, the AUC approved a forecast debt rate of 4.16 percent for 2017 and 4.46 percent for 2018.

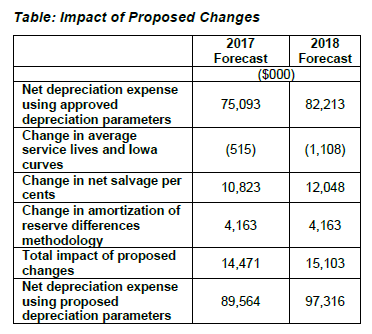

Depreciation

ATCO submitted a new depreciation study in support of its applied-for depreciation expenses (the “Depreciation Study”). The AUC explained that the application reflected two main departures from ATCO’s historical depreciation practices, namely:

(a) determining the average remaining lives of asset accounts based on the equal life group (“ELG”) procedure. Historically, the average remaining life calculation had been based on the broad group (“BG”) procedure; and

(b) rather than using a traditional net salvage study as the basis for net salvage percent recommendations for ATCO’s underground storage asset accounts, the Depreciation Study relied on the results of a decommissioning study prepared by Stantec.

The AUC found that approving ATCO’s requested change to ELG for the purposes of the amortization of reserve differences calculation would be inconsistent with the long standing and wide spread use of the BG procedure in Alberta.

The AUC found that the risk of intergenerational inequity becomes greater if the proposed ELG approach were to be implemented. However, the AUC did not agree that a suitable alternative existed, as the UCA suggested, for ATCO to adopt, on a wholesale basis, the BG procedure for all aspects of ATCO depreciation calculations as a way to resolve the ELG-BG mismatch.

The AUC directed ATCO to revert to the use of the BG procedure for the purposes of determining its amortization of reserve differences calculation and amortization of reserve differences true-up amounts in its compliance filing to the decision.

In reviewing the capitalization policy referenced by ATCO, the AUC noted that it could find no reference to any discussion of asset relocations. The AUC found that it would be beneficial for ATCO to establish a written policy with respect to its treatment of contributions from both an accounting and depreciation study perspective.

The AUC therefore directed ATCO to submit this contribution policy at the time of its next general rate application.

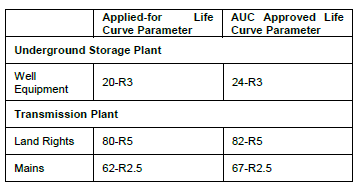

Life Curve Parameters

Specific depreciation parameters proposed in the Depreciation Study not accepted by the AUC are summarized in the table below:

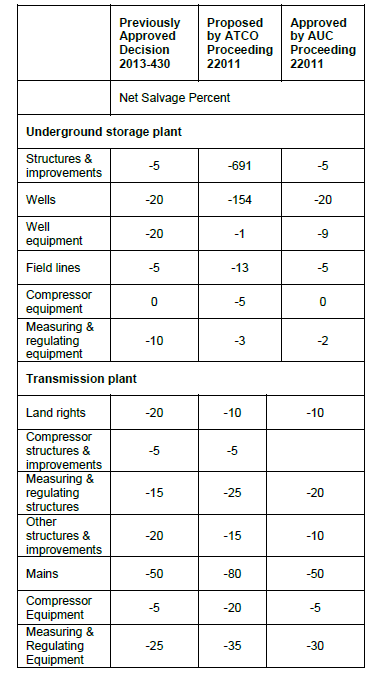

Decommission and Net Salvage

The AUC explained in utility depreciation practices, net salvage refers to the difference between what the company anticipates it will cost to retire its assets from service (cost of removal), and any funds it receives as a result of the asset retirement (gross salvage). The estimate of net salvage is recovered as a component of depreciation expense throughout the life of the assets. A net salvage analysis is undertaken with the objective of ensuring that the net salvage being collected continues to be indicative of future retirement cost expectations.

The AUC noted that, rather than using a traditional net salvage study, ATCO relied on the results of a decommissioning study (the “Decommissioning Study”). The Decommissioning Study did not accompany the Application or Depreciation Study but was provided in response to information requests.

The AUC found that ATCO failed to show the applicability of a Decommissioning Study for determining net salvage percents for its underground storage assets.

Specific net salvage percent parameters proposed in the Decommission Study subject to adjustment by the AUC in this decision are summarized in the table below:

The AUC directed ATCO, in its next depreciation study, to revert back to a traditional net salvage study for the purposes of examining net salvage for its underground storage assets.

Order

The AUC directed that ATCO file a compliance filing in accordance with the findings and directions set out in the decision.