Service and Toll Application – Mainline Service Offering – Long Term Fixed Price Service

On 26 April 2017, TransCanada PipeLines Limited (“TransCanada”) filed an application under Parts I and IV of the National Energy Board Act (“NEB Act”) (the “Application”), requesting the NEB approve:

(a) the Dawn Long Term Fixed Price (“LTFP”) service (the “Dawn LTFP Service” or “Service”);

(b) the tolling methodology and tolls for the Service; and

(c) consequential amendments to the Canadian Mainline Gas Transportation Tariff.

The TransCanada Dawn LTFP Service Application

In the Application, TransCanada submitted, among other things, that:

(a) it negotiated the Dawn LTFP service with western Canadian natural gas producers and subsequently offered it to all prospective shippers through an open season process;

(b) in total, 27 new long-haul contracts were executed with 23 parties for a total of 1.5 petajoules per day (PJ/d), with 1 November 2017 specified as the service commencement date for 90 percent of the contract quantities;

(c) the Dawn LTFP shippers were all producers in the Western Canada Sedimentary Basin (“WCSB”), none of which otherwise hold firm service contracts on the Mainline; and

(d) The net revenue associated with the service was expected to total approximately $2.0 billion over the term of the Dawn LTFP contracts.

Key terms of the Service included:

-

A 10-year contract term, with the option to reduce the term of all or a portion of the contract quantity by one to five years;

-

A fixed demand toll of $0.77 per gigajoule per day (GJ/d), inclusive of the applicable abandonment surcharge and delivery pressure toll, with a higher fixed Dawn LTFP toll applying in the final two years if the shipper elects to reduce its contract term (the “Dawn LTFP Toll”);

-

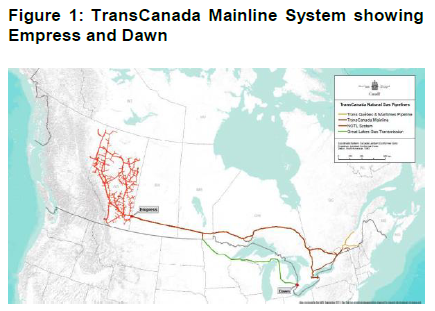

A receipt point of Empress and a delivery point of the Union Southwest Delivery Area (“Dawn”), with no diversion or alternate receipt point rights but with the ability to nominate to select Secondary Delivery points on the Great Lakes Gas Transmission Company (“GLGT”) System on a reasonable efforts basis; and

-

The service was not renewable but could be converted to Firm Transportation (FT) service at the end of the contract term (with 2-years notice).

For the reasons summarized below, the NEB concluded that the Dawn LTFP Service was an appropriate competitive response and approved the Service and tolling methodology as applied-for.

Requirements of the NEB Act

The NEB explained that Part IV of the NEB Act prescribes the NEB’s mandate for traffic, tolls and tariff matters:

-

Section 62 of the NEB Act prescribes that tolls must be just and reasonable and shall always, under substantially similar circumstances and conditions with respect to all traffic of the same description carried over the same route, be charged equally to all persons at the same rate.

-

Section 67 of the NEB Act prohibits a company from making any unjust discrimination in tolls, service or facilities against any person or locality.

To determine whether tolls are just and reasonable and not unjustly discriminatory, the NEB has historically relied on fundamental tolling principles, including the principles of cost-based/user-pay tolls, no acquired rights, and economic efficiency.

NEB Findings

Need for Dawn LTFP Service

The Board finds that a competitive Mainline service, such as offered by the Dawn LTFP Service, was required to attract long-term, long-haul contracts from WCSB producers seeking access to eastern markets. The NEB found, in support of this conclusion, that:

(a) there were currently no Empress to Dawn FT contracts in place, and Dawn LTFP shippers did not hold any firm service on the Mainline; and

(b) current FT service tolls to Dawn were economically prohibitive for producers, and producers would not contract for services when it was not economic to do so.

Rejecting arguments by interveners that the Service was not required given TransCanada’s ability to incent WCSB volumes through pricing discretion, the NEB found that:

(a) long-term firm contracts provide significant benefits for the Mainline relative to discretionary services, including toll certainty and stability; and

(b) the Service provided Dawn LTFP shippers with toll certainty, which would not be achieved by relying on IT (interruptible) service.

The NEB also affirmed its findings from previous Mainline related decisions, that it has provided TransCanada with tools to meet competition with the expectation that TransCanada should meet market forces with market solutions. While acknowledging that the Mainline had returned to relative financial health in recent years, the NEB found that the trend of declining long-haul contracting was clear, and the ongoing issues necessitating proactive solutions remained. The NEB considered that Dawn LTFP Service was an innovative service that used underutilized capacity to attract long-term, long-haul contracts from Empress to Dawn, for the benefit of the Mainline and its shippers.

Benefits and impacts of Dawn LTFP Service

The NEB found that the Service would provide substantial benefits to the Mainline and its shippers. Specifically, the NEB found that the estimated $2 billion of total net revenue associated with the Service would significantly reduce the Mainline revenue requirement allocated to other shippers during the term of the Service.

In the NEB’s view, a key consideration was that Dawn LTFP service would provide a benefit to the Mainline. While the NEB acknowledged the inherent estimation risk to forecasted costs, the NEB concluded that this risk had largely been mitigated by TransCanada, such that there was reasonable certainty that a significant net revenue benefit would occur.

However, to allow the NEB and shippers to track the net revenue benefit of the Service, the NEB directed TransCanada:

(a) to separately track and report annually the actual costs and revenues related to the Dawn LTFP Service; and

(b) to consult with its shipper group to determine an appropriate format for this reporting, which may be filed as part of TransCanada’s quarterly surveillance reports.

Matters of cost allocation should be addressed on system-wide basis

The NEB found that concerns raised by intervenors regarding cost allocation matters would be more appropriately addressed on a system-wide basis, in future proceedings considering all Mainline costs and revenues. Future toll proceedings would require the allocation of Dawn LTFP related costs and revenues to result in just and reasonable tolls, and tolls and services that are not unjustly discriminatory. The NEB stated that it expects that the benefits derived from Dawn LTFP service would be shared in a fair manner amongst Mainline segments and users.

Similarly, the NEB found that the merits of the Industrial Gas Users Association’s (“IGUA”) proposal to include unallocated TBO capacity revenues in the discretionary miscellaneous revenues forecast were more appropriate for evaluation during the 2018 to 2020 tolls application.

Dawn LTFP Toll is just and reasonable

The NEB found the Dawn LTFP Toll to be just and reasonable.

-

Considering its established tolling principles in the context of the competitive circumstances facing WCSB producers and the Dawn market, the NEB’s conclusion was based on findings including:

-

The $0.77/GJ/d Dawn LTFP Toll was a negotiated rate, and not determined on a cost-of-service basis.

-

While the cost-based/user-pay principle is an important principle that helps guide the Board under Part IV of the NEB Act, the competitive circumstances involving the Dawn hub justified the negotiated approach.

-

By offering the negotiated toll, significant volumes would be attracted and net revenues, estimated at $2 billion, would be generated that would otherwise not occur.

-

While the Dawn LTFP toll represents a departure from the cost-based/user-pay principle, economic efficiency would be promoted through increased system utilization and the net lowering of existing Mainline tolls.

No unjust discrimination

The NEB concluded that the Dawn LTFP Toll and Service were not unjustly discriminatory, based on its findings that:

(a) the circumstances under which the Service would be provided were not substantially similar as other services, given the unique competitive pressures existing at the Dawn and the Service having been designed to respond to a specific competitive circumstance;

(b) the Dawn LTFP Service was different traffic than that of other services, based on differing service attributes from FT service including the 10-year term, the lack of alternate receipt point and diversion rights on the Mainline, and the lack of renewal rights; and

(c) accordingly, the Dawn LTFP Service could be charged at a different rate than FT service without offending the prohibition against unjust discrimination set out in section 67 of the NEB Act.

Modifications to the Service would undermine the negotiated package

The NEB rejected numerous changes to the Service suggested by interveners. The NEB stated that it reviewed the suggested changes in the context of the Service being a negotiated package between a group of producers and TransCanada.

The NEB found, that while it had the ability to modify terms of a service in any application, in this case directing modifications to a negotiated package would undermine the negotiation that occurred.

The NEB decided to treat the Dawn LTFP Application as a package deal. Therefore, its limited its consideration to whether that package resulted in tolls that were just and reasonable and service and tolls that were not unjustly discriminatory.

Prudence of TransCanada’s TBO contracting decisions

The NEB affirmed its findings from previous decisions that it does not require TransCanada to seek pre-approval before it enters into TBO agreements. Prudence reviews are appropriately undertaken when TBO costs are applied to be recovered from Mainline shippers in future toll applications.

The NEB stated that it expects TransCanada to optimize net revenue benefits for the Mainline and its shippers over the term of the Service and that this was largely affected by GLGT TBO costs. Future optimized flow-splits and TBO contract quantities would depend on a number of factors, including long-haul contracting decisions and available capacity over the Northern Route.

The NEB noted that in future toll applications, it may disallow any costs found to have been imprudently incurred.

In light of the significant Dawn LTFP volumes and the affiliate relationship with TBO contracting parties, the NEB stated that it expects TransCanada to provide sufficient information in future toll applications for interested parties to assess the prudence of its TBO arrangements related to the Service.

Since TransCanada has the best information that drives its decisions on TBO quantities, the NEB found it reasonable that TransCanada share this information with interested parties in its toll applications.

Based on the above, the NEB directed TransCanada to include, in all future toll proceedings seeking to recover TBO costs related to Dawn LTFP, disaggregated information to support the prudence of Dawn LTFP related TBO costs, including:

(a) information on TBO contracts;

(b) TBO costs, and

(c) Dawn LTFP contract demand and available capacity on relevant Mainline segments.

The NEB further directed that TransCanada provide support for this information including a detailed explanation, including any key assumptions, of TransCanada’s assessment for determining its TBO contracts associated with Dawn LTFP Service.

Decision

The NEB approved the Application as filed.

The NEB directed TransCanada to separately track and report annually the actual costs and revenues related to Dawn LTFP service and to provide, in all future toll proceedings, disaggregated information to support the prudence of Dawn LTFP service-related TBO costs.