Performance-Based Regulation (PBR) – Capital Tracker True-up

In this decision, the AUC considered EPCOR Distribution & Transmission Inc.’s (“EPCOR”) 2016 capital tracker true-up application.

Overview of PBR Capital Tracker Mechanism

The Performance Based Regulation (“PBR”) framework approved in AUC Decision 2012-237 for 2013-2017 PBR plans provides a formula mechanism for the annual adjustment of rates over a five-year term. In general, the companies’ rates are adjusted annually by means of an indexing mechanism that tracks the rate of inflation (“I Factor”) relevant to the prices of inputs less an offset (“X Factor”) to reflect productivity improvements that the companies can be expected to achieve during the PBR plan period. The resultant I-X mechanism breaks the linkages of a utility’s revenues and costs under a traditional cost-of-service model. The PBR framework allows a company to manage its business with the revenues provided for in the indexing mechanism and is intended to create efficiency incentives similar to those in competitive markets.

However, certain items may be adjusted for necessary capital expenditures (“K Factor”), flow through costs (“Y Factor”), or exogenous material events for which the company has no other reasonable cost control or recovery mechanism in its PBR plan (“Z Factor”).

The AUC approved a rate adjustment mechanism to fund certain capital-related costs, referred to as the capital tracker. The capital tracker provides a supplemental funding mechanism for approved amounts to be collected from ratepayers by way of a “K factor” adjustment to the annual PBR rate setting formula.

Projects or programs are eligible for capital tracker treatment if they meet the following three criteria:

(a) the project must be outside the normal course of on-going operations (“Criterion 1”);

(b) ordinarily, the project must be for replacement of existing capital assets or the project must be required by an external party (“Criterion 2”); and

(c) the project must have a material effect on the company’s finances (“Criterion 3”).

Criterion 1: Project Assessment and Accounting Test

Criterion 1 requires a two-stage assessment of each project or program for which capital tracker treatment is requested.

At the first stage (project assessment), an applicant must demonstrate that:

(a) the project is required to provide utility service at adequate levels; and, if so,

(b) the scope, level and timing of the project are prudent, and the forecast or actual costs of the project are reasonable.

At the second stage, an applicant must demonstrate the absence of double-counting (the “Accounting Test”). The Accounting Test requires an applicant to demonstrate that the associated revenue provided by the PBR formula will be insufficient to recover the entire revenue requirement associated with the prudent capital expenditures for the program or project in question.

Criterion 2

With respect to Criterion 2, a growth-related project will generally qualify where an applicant demonstrates that customer contributions and incremental revenues are insufficient to offset the project’s cost.

Criterion 3: Materiality Test

To assess whether a proposed capital tracker has a material effect on a company’s finances, an applicant must satisfy the two-part Criterion 3 materiality threshold, namely, that:

(a) each individual project affects the revenue requirement by four basis points; and

(b) on an aggregate level, all proposed capital trackers must have a total impact on the revenue requirement of 40 basis points.

AUC Review Process for 2016 Capital Tracker True-up

In this decision, the AUC set out its approach for reviewing 2016 capital tracker true-up applications:

For capital projects or programs not considered in prior capital tracker decisions, the AUC would assess all three criteria for capital tracker treatment.

• For projects or programs for which the need was previously confirmed under the project assessment component of Criterion 1, the AUC would not reassess the need in the absence of evidence that the project or program was no longer required. However, the AUC would assess the scope, level and timing of each project or program for prudence, and whether the actual costs of the project or program were prudently incurred, as required by the second part of the project assessment under Criterion 1.

• For programs or projects for which the AUC undertook and approved the assessment against the Criterion 2 requirements in prior capital tracker decisions, it would not reassess this unless the driver for the project or program had changed.

• The AUC would conduct an assessment of the 2016 capital tracker projects and programs with respect to the Accounting Test under Criterion 1 and materiality test under Criterion 3.

AUC Findings re EPCOR 2016 Capital Tracker True-up

The AUC determined that:

(a) EPCOR’s proposed grouping of projects into programs was reasonable;

(b) the need for the capital tracker projects or programs included in the 2016 true-up had previously been confirmed in prior capital tracker decisions;

(c) the actual scope, level, timing and costs of each of the projects or programs included in the 2016 true-up were prudent, subject to the adjustments and directions by the Commission applicable to the Capitalized Underground System Damage, Life Cycle Replacement and Extension of Underground Distribution Cable and Life Cycle Replacement of Network Transformers projects or programs (the “AUC Adjustments and Directions”);

(d) because of the AUC Adjustments and Directions, a reassessment of whether the capital tracker projects or programs satisfied the Accounting Test requirement of Criterion 1 was required;

(e) the previously approved capital tracker projects or programs included in the 2016 true-up continued to satisfy the requirements of Criterion 2; and

(f) because of the AUC Adjustments and Directions, a reassessment of whether the capital tracker projects or programs satisfied the two-tiered materiality test requirement of Criterion 3 was required.

Accordingly, the AUC directed EPCOR to revise its Accounting Test for 2016 in a compliance filing.

Capital Tracker Projects and K-Factor

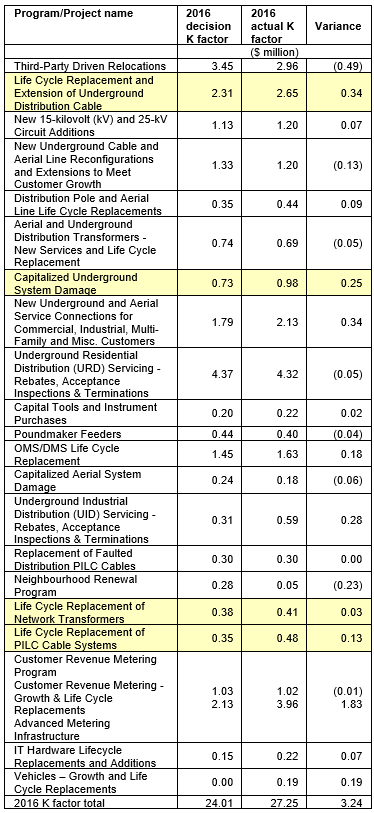

The following table sets out:

(a) the capital tracker forecast amounts approved in Decision 21430-D01-2016 (2016 decision K factor);

(b) the projects and programs included in EPCOR’s 2016 capital tracker true-up (2016 actual K factor); and

(c) the variance between the two, resulting in a proposed K factor true-up for 2016.

EPCOR’s proposed amounts highlighted in yellow were subject to change as a result of the AUC’s Adjustments and Directions, as summarized further below.

Criterion 1: Project Assessment

For the projects/programs listed in the above table, with the exception of those highlighted, the AUC found that:

(a) with respect to the scope, level and timing of each, that capital additions were generally consistent with the scope, level and timing of the work outlined in the business cases for those capital trackers approved in Decision 20407-D01-2016; and

(b) the actual costs for associated procurement and construction practices and the evidence explaining the differences between approved forecast and actual costs, demonstrated such cost to have been prudently incurred.

However, because of the adjustments summarized below, the AUC found that it was unable to determine in this proceeding whether all of EPCOR’s programs or projects included in the 2016 true-up satisfied the project assessment requirement of Criterion 1.

Adjustments and Directions

In the application, EPCOR noted that the Capitalized Underground System Damage Project costs included $0.26 million in closing 2016 construction work in progress that should have been recorded as capital additions in 2016. Accordingly, the AUC directed EPCOR, in the compliance filing to this decision, to add this amount to the Capitalized Underground System Damage Project 2016 capital additions.

In response to an AUC information request, EPCOR identified two other errors; specifically that replacement costs for 10 switching cubicles were recorded to the Capitalized Underground System Damage Project when they should have been recorded to the Life Cycle Replacement and Extension of Underground Distribution Cable Program, and costs in the amount of $0.23 million related to the capitalization of costs related to secondary cable faults were included in this project, which was inconsistent with the Commission’s direction in Decision 20407-D01-2016. Accordingly, the AUC directed EPCOR, in the compliance filing, to remove the amounts related to these two errors from the Capitalized Underground System Damage Project 2016 capital additions, and to add the switching cubicle costs to the Life Cycle Replacement and Extension of Underground Distribution Cable Program 2016 capital additions.

In the application, EPCOR noted that the Life Cycle Replacement of Network Transformers Project costs erroneously included $0.10 million in costs related to the backbone fibre-optic communication system in its 2016 capital additions while it is an EPCOR transmission function asset. Accordingly, the AUC directed EPCOR, in the compliance filing, to remove this amount from the Life Cycle Replacement of Network Transformers Project 2016 capital additions.

Criterion 1: Accounting test

The AUC found that:

(a) EPCOR’s application of the Criterion 1 Accounting Test analysis for the purposes of the 2016 capital tracker true-up was reasonable and generally consistent with the accounting test methodology approved in Decision 2013-435; and

(b) EPCOR used the correct values for WACC, I-X and Q factor assumptions used in the first component of the Accounting Test.

However, because of the adjustments summarized above, the AUC found that it was unable to determine in this proceeding whether all of EPCOR’s programs or projects included in the 2016 true-up satisfied the Accounting Test requirement of Criterion 1.

Criterion 2: Ordinarily the project must be for replacement of existing capital assets or undertaking the project must be required by an external party

The AUC found that because the driver or drivers (e.g., replacement of existing assets, external party, growth) for each project or program included in EPCOR’s 2016 capital tracker true-up had not changed since approval of those proposed capital tracker projects/programs against the Criterion 2 requirements in Decision 3100-D01-2015 and in Decision 20407-D01-2016, there was no need to reassess those programs/projects against the Criterion 2 requirements.

Criterion 3 – The project must have a material effect on the company’s finances

The AUC explained that, in accordance with its determinations in Decision 2013-435, the portion of the revenue requirement for a project or program proposed for capital tracker treatment that is not funded under the I-X mechanism in a PBR year, calculated as part of the accounting test, is then assessed against the two-tiered materiality test under Criterion 3. The first tier of the materiality threshold, a “four basis point threshold,” is applied at a project level. The second tier of the materiality threshold, a “40 basis point threshold,” is applied to the aggregate revenue requirement proposed to be recovered by way of all capital trackers.

The AUC found that EPCOR had generally interpreted and applied the Criterion 3 two-tiered materiality test properly for the purposes of its 2016 capital tracker true-up. However, the two-tiered materiality test under Criterion 3 is calculated as part of the Accounting Test. Given that AUC’s earlier finding that EPCOR’s accounting test for 2016 needed to be revised, the AUC found that it was unable to determine in this proceeding whether any of EPCOR’s programs or projects included in the 2016 true-up satisfied the materiality test requirement of Criterion 3.

The AUC therefore directed EPCOR, in its compliance filing, to reassess whether its programs or projects included in the 2016 true-up satisfy the two-tiered materiality test requirement of Criterion 3.