PBR Plan – Capital Tracker True-up – K factor adjustment

In this decision, the AUC considered AltaGas Utilities Inc.’s (“AltaGas”) 2016 capital tracker true-up application (the “Application”).

For the reasons summarized further below, in this decision, the Commission made the following determinations:

-

because three projects, Drumheller Phase 6 (town), Settler Area 1 (town), and Erskine (rural) were not previously determined by the AUC to be needed, the AUC assessed these projects and found all three to be needed.

-

the actual scope, level, timing and actual costs of each of the projects or programs included in the 2016 true-up were prudently incurred and satisfied the project assessment requirement of Criterion 1.

-

the capital tracker projects or programs included in the 2016 true-up continued to meet the requirements of the accounting test under Criterion 1.

-

there was no need to reassess the project or program requirements against Criterion 2, unless the driver for the project or program had changed.

-

the projects or programs included in the 2016 true-up satisfied the materiality requirement under Criterion 3.

-

with one exception (discussed below), the AUC found that AltaGas complied with previous Commission directions.

Overview of PBR Capital Tracker Mechanism

The Performance Based Regulation (“PBR”) framework approved in AUC Decision 2012-237 for 2013-2017 PBR plans provides a formula mechanism for the annual adjustment of rates over a five-year term. In general, the companies’ rates are adjusted annually by means of an indexing mechanism that tracks the rate of inflation (“I Factor”) relevant to the prices of inputs less an offset (“X Factor”) to reflect productivity improvements that the companies can be expected to achieve during the PBR plan period. The resultant I-X mechanism breaks the linkages of a utility’s revenues and costs under a traditional cost-of-service model. The PBR framework allows a company to manage its business with the revenues provided for in the indexing mechanism and is intended to create efficiency incentives similar to those in competitive markets.

However, certain items may be adjusted for necessary capital expenditures (“K Factor”), flow through costs (“Y Factor”), or exogenous material events for which the company has no other reasonable cost control or recovery mechanism in its PBR plan (“Z Factor”).

The AUC approved a rate adjustment mechanism to fund certain capital-related costs, referred to as the capital tracker. The capital tracker provides a supplemental funding mechanism for approved amounts to be collected from ratepayers by way of a “K factor” adjustment to the annual PBR rate setting formula.

Projects or programs are eligible for capital tracker treatment if they meet the following three criteria:

(a) the project must be outside the normal course of on-going operations (“Criterion 1”);

(b) ordinarily, the project must be for replacement of existing capital assets or the project must be required by an external party (“Criterion 2”); and

(c) the project must have a material effect on the company’s finances (“Criterion 3”).

Criterion 1: Project Assessment and Accounting Test

Criterion 1 requires a two-stage assessment of each project or program for which capital tracker treatment is requested.

At the first stage (project assessment), an applicant must demonstrate that:

(a) the project is required to provide utility service at adequate levels; and, if so,

(b) the scope, level and timing of the project are prudent, and the forecast or actual costs of the project are reasonable.

At the second stage, an applicant must demonstrate the absence of double-counting (the “Accounting Test”). The Accounting Test requires an applicant to demonstrate that the associated revenue provided by the PBR formula will be insufficient to recover the entire revenue requirement associated with the prudent capital expenditures for the program or project in question.

Criterion 2

With respect to Criterion 2, a growth-related project will generally qualify where an applicant demonstrates that customer contributions and incremental revenues are insufficient to offset the project’s cost.

Criterion 3: Materiality Test

To assess whether a proposed capital tracker has a material effect on a company’s finances, an applicant must satisfy the two-part Criterion 3 materiality threshold, namely, that:

(a) each individual project affects the revenue requirement by four basis points; and

(b) on an aggregate level, all proposed capital trackers must have a total impact on the revenue requirement of 40 basis points.

AUC Review Process for 2016 Capital Tracker True-up

In this decision, the AUC set out its approach for reviewing 2016 capital tracker true-up applications:

-

For capital projects or programs not considered in prior capital tracker decisions, the AUC would assess all three criteria.

-

For projects or programs for which the need was previously confirmed under the project assessment component of Criterion 1, the AUC would not reassess the need in the absence of evidence that the project or program was no longer required. However, the AUC would assess the scope, level and timing of each project or program for prudence, and whether the actual costs of the project or program were prudently incurred, as required by the second part of the project assessment under Criterion 1.

-

For programs or projects for which the AUC undertook and approved the assessment against the Criterion 2 requirements in prior capital tracker decisions, it would not reassess this unless the driver for the project or program had changed.

-

The AUC would conduct an assessment of the 2016 capital tracker projects and programs with respect to the Accounting Test under Criterion 1 and materiality test under Criterion 3.

-

To the extent the AUC had previously approved the grouping of projects for capital tracker purposes, it would not re-evaluate these groupings in this decision.

Programs or projects for which AltaGas had sought a capital tracker true-up in 2016 on an actual basis

The AUC noted it previously approved capital tracker treatment for the three programs: Pipeline Replacement, Station Refurbishment and Gas Supply.

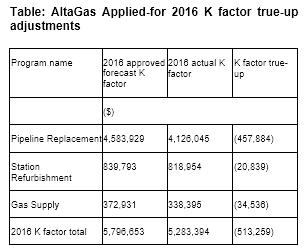

These programs included in the 2016 capital tracker true-up and the variance from the approved forecast, resulting in a K factor true-up for 2016, are set out in the table below.

Capital Tracker Programs and Grouping of Projects

The AUC set out the three capital tracker programs for which it had previously approved the need for as part of the project assessment under Criterion 1, namely:

(a) the Pipeline Replacement Program: a multi-year program for the replacement of certain types of pipe;

(b) the Station Refurbishment Program: a multi-year program for the replacement or refurbishment of three station types: purchase meter stations (“PMS”), town border stations (“TBS”) and post-regulator stations (“PRS”); and

(c) the Gas Supply Program: a multi-year program to ensure safe, continuous gas supply to customers.

Given that the groupings in the Application were the same as those previously approved, the AUC found that there was no need to re-evaluate those groupings in this decision.

Project Assessment under Criterion 1

Under the project assessment requirements of Criterion 1, the AUC assessed whether the actual scope, level, timing and costs of the project were prudent.

Considering the individual projects within the Pipeline Replacement Program

The Pipeline Replacement Program (“PRP”) consisted of projects for the replacement of three types of pipes:

(a) pre-1957 steel pipe;

(b) polyvinylchloride (“PVC”) pipe; and

(c) non-certified and interim-certified polyethylene (PE) (“non-certified PE”),

(collectively, the “PRP Projects”).

The AUC previously approved, for capital tracker treatment purposes, the need on a forecast basis for each of the pre-1957 steel, PVC and Non-Certified PE PRP Projects (the “Approved PRP Projects”), except for Drumheller Phase 6 (town), Settler Area 1 (town), and Erskine (rural).

Given that the AUC previously evaluated the Approved PRP Projects against the project assessment component of Criterion 1, AltaGas was not required to demonstrate that these projects were needed in 2016 if there was no evidence on the record to show otherwise.

In this case, the AUC found that:

(a) there was no evidence on the record to indicate that any of the PRP Projects were not required in 2016;

(b) with respect to the scope, level and timing of each of the Approved PRP Projects carried out in 2016, the AUC found that the actual capital additions associated with each of the projects and were generally consistent with the scope, level and timing of the work outlined in the previously approved business case;

(c) the actual scope, level, timing and costs of the work undertaken in 2016 were prudent; and

(d) accordingly, each of the Approved PRP Projects satisfied the project assessment requirement of Criterion 1 for 2016.

As the AUC previously determined in Decision 2012-237 and in Decision 2013-435, in this decision the AUC confirmed that a company may undertake a capital investment project prior to applying for capital tracker treatment. This was the case for the two pre-1957 steel pipe replacement projects (Drumheller Phase 6 (town) and Settler Area 1 (town)) and the one Non-Certified PE pipe replacement project (Erskine (rural)) (the “2016 PRP Projects”).

For these projects, which AltaGas had undertaken in 2016 without first obtaining AUC approval for capital tracker treatment thereof, the AUC found that the 2016 PRP Projects were needed and that it was prudent for AltaGas to undertake them.

With respect to the scope, level and timing of the work associated with the three 2016 PRP Projects, the AUC found that:

(a) the information provided by AltaGas regarding each project was generally consistent with the scope, level and timing of the work outlined in the business case approved for the PRP; and

(b) the costs of the PRP were prudent, based on the AUC’s review of the variances between the internally-approved cost estimates and the actual 2016 costs incurred and AltaGas’ explanations for these variances.

Considering the Individual projects within the Station Refurbishment Program

In Decision 20522-D02-2016, the AUC approved the need on a forecast basis, for each of the Station Refurbishment Program projects, for purposes of capital tracker treatment in 2016. The AUC also determined that the proposed scope, level, timing and forecast costs for these projects and programs were reasonable.

In this decision, the AUC found that:

(a) with respect to the true-up of 2016 actual costs, there was no evidence on the record to indicate that any of the station replacement and refurbishment projects included in the Application were not required in 2016;

(b) with respect to the scope, level and timing of each of the PMS, TBS and PRS station replacement and refurbishment projects carried out in 2016, these projects were generally consistent with the scope, level and timing of the work outlined in the business case approved in Decision 20522-D02-2016; and

(c) the actual scope, level, timing and costs of the work undertaken in 2016 were prudent.

Accordingly, the AUC found that the Station Refurbishment Program and each of the associated PMS, TBS and PRS station replacement and refurbishment projects approved in Decision 20522-D02-2016, and carried out in 2016, satisfied the project assessment requirement of Criterion 1 for 2016.

Considering individual projects within Gas Supply Program

In Decision 20522-D02-2016, the AUC approved a 2016 gas supply placeholder of $661,250, as AltaGas was anticipating 2016 expenditures associated with a Gas Supply Project to address the potential imminent loss of existing gas supply but was still in the process of examining potential alternatives and the associated costs.

In the Application, AltaGas advised that it was unclear when, or to what extent, area producers would be successful in accessing liquids-rich production. AltaGas therefore was continuing to monitor the situation. In the interim, since no assets were placed into service specifically related to gas supply, AltaGas proposed refunding the K factor adjustment related to the 2016 placeholder.

Since no assets were placed into service specifically related to gas supply, the AUC approved AltaGas’ request to refund to customers the K factor adjustment.

Accounting Test under Criterion 1

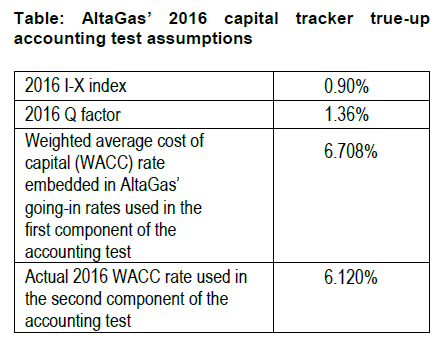

AltaGas used the following assumptions in its accounting test:

The AUC noted that:

-

The 2016 I-X index of 0.90 percent was approved in Decision 20823-D01-2015.

-

The 2016 Q factor of 1.36 percent was based on the billing determinants forecast approved in Decision 20823-D01-2015.

-

AltaGas’ actual 2016 WACC rate of 6.120 percent was based on the actual cost of debt of 4.541 percent, the approved equity thickness of 41 percent and the approved return on equity (“ROE”) of 8.3 percent, as determined in the 2016 generic cost of capital Decision 20622-D01-2016.

-

AltaGas’ actual 2016 cost of debt of 4.541 per cent, as reported in its 2016 Rule 005 filing, was a blend of its new $45 million long-term debt issued in 2016 with a coupon rate of 4.20 per cent, and rates for six prior debt issues dating back to 2009.

The AUC found that:

(a) AltaGas’ used the correct WACC, I-X and Q factor assumptions and values for the first component of the accounting test;

(b) AltaGas’ 2016 actual WACC of 6.120 per cent used in the second component of its accounting test, based on the 2016 actual cost of debt of 4.541 per cent, as well as the approved equity thickness of 41 per cent and the approved ROE of 8.3 per cent from Decision 20622-D01-2016, were reasonable; and

(c) AltaGas’ accounting test model sufficiently demonstrates that all of the actual expenditures for a capital project were, or a portion was, outside the normal course of the company’s ongoing operations, as required to satisfy the accounting test component of Criterion 1.

Criterion 1 Conclusion

The AUC concluded that:

-

AltaGas’ programs or projects proposed for capital tracker treatment in 2016 on an actual basis satisfied the project assessment requirement of Criterion 1.

-

All of AltaGas’ actual expenditures for a capital project were, or a portion was, outside the normal course of the company’s ongoing operations, as required to satisfy the accounting test component of Criterion 1.

Criterion 2 – ordinarily the project must be for replacement of existing capital assets or undertaking the project must be required by an external party

Because the driver or drivers (e.g., replacement of existing assets, external party, growth) for each project or program included in AltaGas’ 2016 capital tracker true-up had not changed since they were approved for capital tracker treatment, the AUC did not need to reassess these programs or projects against the Criterion 2 requirements.

For the three 2016 PRP Projects, given AltaGas’ confirmation that there were no changes to the drivers of any of its previously approved capital tracker programs, the AUC found that these three projects satisfied the requirements of Criterion 2.

Criterion 3

The AUC found that, based on its review of AltaGas’ calculations:

(a) AltaGas interpreted and applied the Criterion 3 two-tiered materiality test correctly for the purposes of its 2016 capital tracker true-up; and

(b) each of AltaGas’ proposed capital tracker programs for 2016 exceeded the materiality thresholds, and therefore satisfied Criterion 3.

2016 K factor True-up Calculation and Order

Based on its review of AltaGas’ calculations, the AUC found that AltaGas’ methodology to determine the 2016 K factor true-up amount satisfied the requirements set out in Decision 2012-237 and Decision 2013-435

The AUC therefore approved:

(a) the 2016 K factor true-up refund amount of $513,259; and

(b) AltaGas’ proposal to refund this amount as part of either AltaGas’ application to establish the 2018 PBR rates or in its next Rate Rider F application, whichever occurs first.