PBR Plan – Z Factor – Wildfire – Asset Retirement – Used or Required to be Used

In this decision, the AUC considered ATCO Gas, a division of ATCO Gas and Pipelines Ltd.’s (“ATCO”) application to recover $11.199 million through a Z factor rate adjustment for the costs it incurred as a result of the 2016 Regional Municipality of Wood Buffalo wildfire (the “Wildfire”).

For the reasons summarized below, the AUC determined that:

(a) for 2016, all five of the criteria to qualify for a Z factor rate adjustment had been met;

(b) the Wildfire was of a similar nature and magnitude to other nature-related events identified in ATCO Gas’ 2009 depreciation study; and

(c) the Wildfire did not give rise to an extraordinary retirement of the destroyed assets.

Therefore, the depreciation expense associated with the assets that were replaced would continue to be recovered from ratepayers.

Performance-Based Regulation Plan and Z Factor

Background

The AUC set out the following regarding the performance-based regulation (“PBR”) plans for the distribution utility services of certain Alberta electric and gas companies, including ATCO:

-

Decision 20414-D01-2016 approved PBR plans for the Alberta distribution companies for a five-year term commencing January 1, 2018. In that decision, the AUC confirmed that the Z factor approach was to remain unchanged from that established in the first PBR plans Decision 2012-237.

-

The PBR framework provides a formula mechanism for the annual adjustment of rates for those companies under an approved PBR plan. In general, rates are adjusted annually by means of an indexing mechanism that tracks the rate of inflation (I) relevant to the prices of inputs the companies use, less a productivity offset (X) to reflect the productivity improvements the company can be expected to achieve during the PBR plan period.

-

Establishing prices in this way during the term of a PBR plan is intended to create stronger incentives for the companies to improve their efficiency because they are able to retain the increased profits generated by those cost reductions longer than they would under cost-of-service regulation.

-

At the same time, under a PBR framework, customers automatically share in the expected productivity gains because they are built into rates through the X factor regardless of the actual performance of the companies.

With respect to the Z factor component of PBR plans, the AUC explained:

-

The Z factor recognizes that, in competitive markets, exogenous factors that affect only the industry in question, such as an increase in taxes, would be passed through to customers by that industry in its market prices.

-

The Z factor is intended to deal with significant events outside the companies’ control that are specific to the industry and would not be reflected through the I factor.

-

The Z factor can also be used to account for cost changes caused by unique company-specific events (such as floods or ice storms) outside the company’s control and that are not reflected in the I factor.

-

In Decision 2012-237, the Commission established the following criteria to be applied when evaluating whether the impact of an exogenous event qualifies for Z factor treatment:

(1) The impact must be attributable to some event outside management’s control.

(2) The impact of the event must be material. It must have a significant influence on the operation of the company otherwise the impact should be expensed or recognized as income, in the normal course of business.

(3) The impact of the event should not have a significant influence on the I factor in the PBR formulas.

(4) All costs claimed as an exogenous adjustment must be prudently incurred.

(5) The impact of the event was unforeseen.

-

Z factors should be symmetrical in that they should apply to exogenous events with both additional costs that the company needs to recover and also reductions to costs that need to be refunded to customers.

Criterion 1 & 5: Impact Attributable to Unforeseen Event Outside Management’s Control

The AUC found that the specific timing and location of the wildfire and its impact to the Fort McMurray area had an impact which was unforeseen and outside of management’s control, thus satisfying the criteria for Z factor treatment related to an impact attributable to unforeseen events outside management’s control.

Criterion 4: Exogenous Adjustment Must Be Prudently Incurred

The AUC considered whether the costs claimed as an exogenous adjustment, namely capital expenditures, operations and maintenance (“O&M”) costs and lost revenue, were prudently incurred.

For the reasons summarized further below, the AUC found that:

(a) the scope of the work performed, the timing of the repair and replacement activity and the quantum of the capital costs to be prudent, subject to a minor correction identified by ATCO related to received insurance payment;

(b) O&M costs claimed for 2016 as an exogenous adjustment were prudent; and

(c) with respect to lost revenue:

(i) but for the wildfire, the customers with sites destroyed by fire (1,620), and the customers with sites materially damaged by fire and not inhabitable (440) would have remained as customers and ATCO Gas would have received revenues from these customers; and

(ii) accordingly, the revenue lost as a result of the wildfire for these customers was eligible for inclusion in the Z factor adjustment.

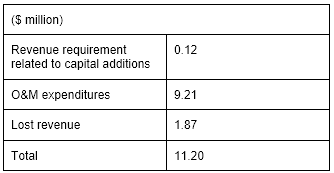

ATCO’s applied-for revenue requirement related to capital additions, O&M expenditures and lost revenue, included in this Z factor application, is set out in the table below:

Table: Components of the proposed exogenous adjustment

Capital Expenditures

Regulatory treatment of destroyed assets

The AUC determined that the destroyed assets should be treated as an ordinary retirement and accounted for accordingly, noting that no party disputed that, as a result of the wildfire, the destroyed assets were retired in the ordinary course of business.

The AUC held that whether a retirement is ordinary or extraordinary will turn on whether the event that destroyed the utility assets had been contemplated or anticipated by a prior depreciation study. An event will give rise to an extraordinary retirement if the characteristics of the event (e.g. fire) in question cannot be said to have been reasonably contemplated or anticipated in the determination of the depreciation parameters in the prior depreciation study (citing Decision 27388-D01-2016).

In this case, the AUC considered ATCO’s history of losses due to natural disasters or other force majeure events similar in nature to the wildfire. In this regard, the AUC found that the replacement costs of the 2016 wildfire were $2.2 million, which were similar to the replacement costs of the 2005 flood and other nature-related events that were incorporated into the 2009 depreciation study.

The AUC directed ATCO, in the compliance, to provide all accounting entries reflecting the retirement of the assets destroyed by the wildfire. ATCO was also directed to indicate how the remaining net book value of the destroyed assets will be recovered from customers.

Utility Asset Disposition Principles: Used or required to be used

Section 37 of the Gas Utilities Act describes the assets that determine a gas utility’s rate base as those assets that are “used or required to be used to provide service to the public.”

In Decision 2013-417, known as the Utility Asset Disposition (“UAD”) decision, the Commission considered the interpretation of “used or required to be used” by the courts, and made, inter alia, the following findings:

-

The words “used or required to be used” in Section 37 of the Gas Utilities Act “are intended to identify assets that are presently used, are reasonably used, and are likely to be used in the future to provide services. The past or historical use of assets will not permit their inclusion in the rate base unless they continue to be used in the system.”

-

The “only reasonable reading of s. 37 is that the assets that are ‘used or required to be used’ to provide service are only those used in an operational sense.”

-

The effective date for removal of a gas utility asset from rate base and customer rates is the earlier of: (i) the date that the utility advises the AUC that the asset is no longer used or required to be used; or (ii) the date the AUC determines that an asset no longer has an operational purpose and is no longer used or required to be used to provide service to the public.

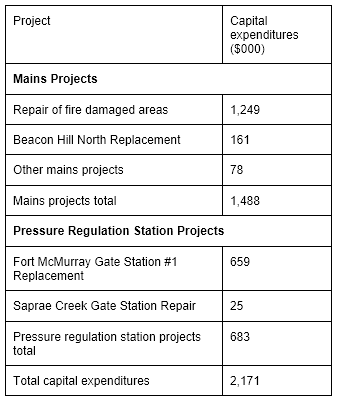

ATCO stated that it incurred $2.2 million in capital expenditures to repair, replace or alter mains and pressure regulating stations that were damaged in the wildfire. The costs incurred for related projects are summarized in the table below.

Table: Mains and Stations Project costs

Regarding mains, for those mains that supplied customers further along the line, the AUC accepted ATCO Gas’s explanation that “While there may not be active services along some sections of a particular main, the full length of main needed to be repaired in order to maintain safe and reliable service to customers further along the line.” The AUC further found that:

(a) evacuated residents were only permitted to return once certain reentry conditions were met, including the availability of essential services such as gas utility service;

(b) ATCO Gas would not have known when and if customers would return to the affected areas, and that it expected customers to return intermittently; and

(c) therefore, it was incumbent on ATCO Gas to meet its obligation to supply service to active sites located downstream of destroyed areas, as well as to inactive sites to ensure facilities were in place to provide gas utility service to customers when they returned.

Accordingly, the AUC found that, for 2016, the replacement assets including stations and mains were presently used, reasonably used and likely to be used in the future to provide service.

However, the AUC considered that it did have sufficient evidence to determine whether ATCO would have known when and if customers would return to the affected areas in 2017. The AUC therefore declined to make any determination as to whether all the mains were used or required to be used after 2016.

Given the uncertainty of whether all of the repaired and replaced mains and related assets would continue to be used or required to be used after 2016, the AUC directed ATCO to provide the following in its compliance filing:

(a) whether all or any of the mains and related assets that the Commission found were used or required to be used in 2016 continue to be used or required to be used after 2016;

(b) a map showing the locations of the mains or portions thereof, and related assets, that do not supply any customers;

(c) the net book value of mains or portions thereof, and related assets, that do not supply any customers;

(d) for the mains or portions thereof, and related assets, that do not supply any customers, and ATCO Gas submits are required to be used:

(i) the month and year that ATCO Gas expects customers to connect to the main; and

(ii) the basis of the forecast for the aforementioned month and year that ATCO Gas expects customers to connect to the main;

(e) with respect to the mains and related assets that the Commission found were used or required to be used in 2016, whether UAD principles apply after 2016 to exclude all or a portion of these mains and related assets from rate base after 2016; and

(f) if all or any of the mains and related assets that the Commission found were used or required to be used in 2016 were no longer used or required to be used in subsequent years, what adjustments to rate base were required, if any and when such adjustments would be made.

O&M Costs

ATCO stated that in 2016 it incurred incremental O&M costs and lost revenue of $11.1 million as a result of the wildfire.

The AUC found that:

(a) ATCO Gas worked diligently and effectively to ensure the safety of the gas distribution system, to support critical facilities during the event and to return gas utility service to its customers to facilitate the reentry of residents to evacuated areas; and

(b) the timing of these activities, the scope of the work completed, and the O&M costs of $9.2 million incurred in response to this event in 2016, to enable service, were reasonable.

The AUC concluded that the O&M costs claimed for 2016 as an exogenous adjustment were prudent.

Lost Revenue

The Z factor allows for an adjustment to a company’s rates to account for the significant financial impact of an event outside of the control of management. This can include lost revenue. The event must not have an economy-wide impact. Otherwise the cost of that impact would be reflected and recovered in the I factor.

ATCO applied to recover $1,867,000 of lost revenue. ATCO calculated this lost revenue by comparing the actual rate revenue to the rate revenue forecast for the Fort McMurray weather zone for the eight-month period May 1, 2016, to December 31, 2016.

The AUC found that:

(a) but for the wildfire, the customers with sites destroyed by fire (1,620), and the customers with sites materially damaged by fire and not inhabitable (440) would have remained as customers, and ATCO Gas would have received revenues from these customers; and

(b) accordingly, the revenue lost as a result of the wildfire for these customers was eligible for inclusion in the Z factor adjustment, and would be recoverable if the Z factor materiality threshold was achieved.

However, with respect to 190 sites where the site itself was not destroyed or materially damaged, and the customer had not requested reconnection, the AUC found that there may be factors other than the wildfire that prevented these customers from returning. As such, the AUC determined that ATCO Gas may not collect the lost revenue calculated for these 190 sites, other than the revenue lost during the mandatory evacuation period.

The AUC directed ATCO Gas to recalculate lost revenue by excluding these 190 sites in its compliance filing.

Criterion 2: Materiality

In Decision 2012-237, the Commission approved a Z factor materiality threshold as the dollar value of a 40-basis points change in after-tax ROE, which was used to determine the revenue requirement for ATCO Gas’ 2012 going-in rates. The threshold is to be adjusted annually by the I-X index.

ATCO Gas North’s 2016 materiality threshold was $1.508 million. This threshold was approved in Decision 21606-D01-2016, for the purposes of ATCO’s K factor calculation, which used the same 40 basis point ROE methodology for its calculation. In the application, ATCO noted that the earnings impact of $8.2 million from this event was in excess of the AUC approved materiality threshold.

The AUC found that ATCO Gas’ Z factor was material, after accounting for adjustments directed elsewhere in the decision, given that ATCO Gas’ applied-for Z factor adjustment of $11.2 million for costs incurred in 2016 significantly exceeded the approved 2016 materiality threshold of $1.508 million.

Criterion 3: Significant Influence on the Inflation Factor in the PBR Formula

The AUC considered whether the impact of the event had a significant influence on the inflation factor in the PBR formula.

In Decision 2012-237, the Commission held that “… providing the company with additional revenues through a Z factor adjustment in circumstances where the event has economy-wide impacts would result in a double-counting of the impact of the exogenous event.”

The AUC found that there was insufficient evidence to conclude that the wildfire had a significant influence on the measures of inflation in Alberta included in the I factor and therefore, there was no double-counting of revenue if the Z factor were approved.

Conclusion

The AUC determined that ATCO’s 2016 costs related to the wildfire experienced in the Regional Municipality of Wood Buffalo met all the criteria for Z factor treatment, subject to certain adjustments. Therefore, the AUC approved ATCO Gas’ application to include the wildfire Z factor adjustment in its 2019 annual PBR rate adjustment.