Generic Cost of Capital

The AUC initiated Proceeding ID No 2191 to assess the 2013 Generic Cost of Capital (“GCOC”). The reasons provided by the AUC pertaining to the GCOC apply to the following utilities:

(a) AltaGas Utilities Inc.;

(b) AltaLink Management Ltd.;

(c) ATCO Electric Ltd.;

(d) ATCO Gas;

(e) ATCO Pipelines;

(f) ENMAX Power Corporation;

(g) EPCOR Distribution & Transmission Inc.;

(h) FortisAlberta Inc.; and

(i) TransAlta Corporation (“TransAlta”),

(collectively, the “Alberta Utilities”, except TransAlta).

All of the above utilities participated in the GCOC proceeding, in addition to the Office of the Utilities Consumer Advocate (“UCA”), the Consumers’ Coalition of Alberta (“CCA”), the Canadian Association of Petroleum Producers (“CAPP”), and the City of Calgary (“Calgary”). The decision also affects the following utilities that did not participate in the GCOC proceeding:

(a) EPCOR Energy Alberta GP Inc. (“EEA”);

(b) ENMAX Energy Corporation (“EEC”);

(c) Direct Energy Regulated Services (“DERS”);

(d) City of Lethbridge;

(e) City of Red Deer; and

(f) Investor-owned water utilities regulated by the AUC.

The return on equity (“ROE”) and debt to equity ratios do not apply to EEA, EEC or DERS, as those utilities are regulated pursuant to the Electric Utilities Act Regulated Rate Option Regulation and the Gas Utilities Act Default Gas Supply Regulation.

The AUC approached the decision in a similar fashion to its previous GCOC decisions, such as Decision 2011-474, by establishing a generic ROE that uniformly applied to all the affected utilities, and thereafter applying adjustments to the capital structure of each utility according to their respective business risks.

In establishing a fair ROE for the utilities, the AUC evaluated changes in the global and Canadian financial environment since the last GCOC proceeding, then sets a benchmark generic ROE. Impacts from the Utilities Asset Disposition proceeding (Decision 2013-417 (the “UAD Decision”)), and from the implementation of the performance-based regulation (“PBR”) mechanism for several of the distribution utilities are considered in addition to the generic ROE.

Changes in Global Economic and Canadian Capital Market Conditions

With respect to changes in global economic and Canadian capital market conditions since the last GCOC, the Alberta Utilities set out that despite declines in risk since 2011, the “systemic risks” remained higher than the 2008-2009 crisis, citing abnormally low bond rates as a sign of non-normal market conditions. Most other interveners argued that the financial risks from the 2008-2009 crisis have abated or stabilized, pointing to rate stability for A-rated utility yield spreads since 2011.

The AUC held that the global economic and Canadian capital market conditions had improved since the last GCOC proceeding, noting that the bond yield spreads were no longer elevated, indicating a return to normal economic conditions.

Capital Asset Pricing Models

With respect to establishing a generic ROE, the AUC considered a wide range of tests, including, capital asset pricing models (“CAPM”).

The CAPM accounts for both the time-value and risk-value of money, by establishing a risk-free rate equivalent to investments in risk-free security, and then calculating a risk premium to reflect the possibility that the expected return may not be achieved. CAPP supported the application of the CAPM, citing its widespread use in financial analysis. The Alberta Utilities offered a variation of the CAPM, which they referred to as a risk-adjusted equity market risk premium test, which incorporates discounted cash-flow (“DCF”) methods.

The AUC held that in arriving at its generic ROE, it would ascribe notable weight to the CAPM among the alternatives put forth in the GCOC proceeding, as it determined the CAPM to be a theoretically sound and useful tool for estimating ROE.

Risk-Free Rate

In assessing the risk-free rate, the Alberta Utilities offered a risk-free rate of 4.0 percent, based on the consensus forecasts for 10-year government of Canada bond yields, and adding a spread of 45 basis points to account for both recent and historic yield spreads on the government of Canada bond yields. The CCA supported this risk-free rate. CAPP submitted that a risk-free rate of 3.6 percent was more appropriate, taking into account the recent bond buying program in the United States depressing interest rates generally. The UCA submitted that risk free rates were in the range of 2.4 to 3.2 percent for 2013, 3.1 to 3.9 percent for 2014, and 3.3 to 4.1 percent for 2015, based on the December 2013 consensus forecasts, and assuming a 50 basis point spread of long-term bond yields over 10-year yields persists through 2015.

The AUC held that a reliance on consensus forecasts of long-term government of Canada bond yields to estimate the risk-free rate was reasonable. The AUC also held that the Alberta Utilities’ upward adjustment to the risk-free rate had the potential to result in over-compensation. Therefore, the AUC considers the actual long-term rate of 2.8 percent to be a reasonable lower bound estimate, and 3.7 percent to be a reasonable upper bound of the risk-free rate.

Market Equity Risk Premium

In addressing the market equity risk premium, the AUC cited the general overlap of expert conclusion on this area, and determined that a risk premium of approximately 5.0 to 6.0 percent above the risk-free rate was appropriate. Therefore, the AUC determined that a long-run historical market equity risk premium of 5.0 percent continued to be a reasonable lower bound for the risk premium in the CAPM, but due to the persistence of low interest rates, the AUC accepted that a reasonable upper bound was 7.0 percent for the market equity risk premium.

The AUC continued to apply a “flotation allowance” of 50 basis points to provide an additional margin of safety for utilities when raising financing.

As a result, the AUC held that the CAPM ROE would be between 5.80 percent and 8.75 percent, using the lower and upper bounds of each component in the CAPM.

DCF Model

The AUC also considered the DCF model in developing a generic ROE. The DCF model uses two components: the dividend yield, and an expected growth in dividends and earnings.

The Alberta Utilities argued that the AUC should provide greater weight to the DCF model, pointing to “clear systemic problems of the CAPM.” However, CAPP opposed placing such weight on the DCF model, noting that the expert evidence provided by the Alberta Utilities, assumed unreasonably high growth rates.

The AUC held that the DCF model is a relevant, and theoretically well-grounded economic method for estimated ROE. However, the AUC noted that it was less widely used than the CAPM, and that there was significant disagreement as between the parties on the variants of DCF used, and the outcomes predicted by each.

ROE and Adjustments or Modifications

The ultimate range of ROE recommendations by each of the parties was as follows:

(a) Alberta Utilities – ROE of 10.50 percent for 2013, 2014, and 2015;

(b) UCA – ROE of 6.78 percent for 2013, 7.27 percent for 2014, and 7.42 percent for 2015; and

(c) CAPP and CCA – ROE of 7.50 percent for 2013, 2014, and 2015.

Taking into account all of the above, including the reasonable lower and upper bounds recommended by each of the different tests, the AUC determined that a generic ROE of 8.3 percent was reasonable for each of 2013, 2014 and 2015.

In assessing whether any modifications to the ROE were necessary as a result of the UAD Decision, the AUC determined that in theory, the utility shareholders have been subject to a greater degree of risk than they were prior to the outcome of the UAD Decision. However, the AUC also noted that, if the risk were perceptible, the investing public would have created an increase in credit spreads for the Alberta Utilities, which was not supported by the evidence on the record. Therefore the AUC determined that no such adjustment was necessary at this time.

The AUC also considered whether the introduction of PBR required any adjustment to the ROE. The AUC noted that while PBR does impose some degree of risk, the adoption of the ability for utilities under PBR to apply for capital tracker amounts and various other pass-through costs did not significantly affect the cost of capital enough to require an adjustment to the generic ROE.

The AUC lastly considered whether to implement an automatic adjustment mechanism to its generic ROE for 2013, 2014 and 2015. The AUC noted that the parties were in agreement that if such a formula were to be adopted, it must account for changes in government bond yields, and changes in utility bond spreads. However, the Alberta Utilities did not support the implementation of such an adjustment until government of Canada long-term bond yields exceeded 4.0 percent. The AUC held that it would not implement an automatic adjustment mechanism at this time, but noted that such a mechanism may be warranted if market conditions warrant it at some later date.

Capital Structure of Utilities

As the second part of its GCOC determinations, the AUC considered the capital structure of each of the utilities regulated by the AUC. In particular, the AUC noted that its determinations affected the allowed percentage of rate base, net of no-cost capital, which was supported by common equity, as opposed to debt. The AUC’s approach was to analyze the equity ratios that are required for the affected utilities to target credit ratings in the A-range. The AUC noted that in Decision 2009-216 and 2011-474, it observed the following minimum credit metrics as associated with A-grade credit ratings:

(a) Earnings before Interest and Taxes (“EBIT”) coverage of 2.0 times;

(b) Funds from Operations (“FFO”) coverage of 3.0 times; and

(c) FFO/debt ratio of 11.1 to 14.3 per cent.

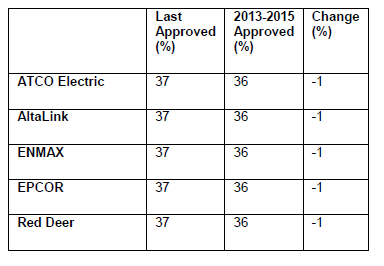

The Alberta Utilities requested increases of two percent to their equity ratios, compared with the AUC’s determinations in Decision 2011-474. The prior approved equity ratios, and equity ratios recommended by the Alberta Utilities are as follows:

The City of Calgary also requested lower equity ratios, arguing that higher equity ratios only serve to benefit equity holders. The AUC disagreed with this approach, and held that the purpose of setting an allowable equity ratio was to minimize debt costs, which are eventually borne by ratepayers, and the primary vehicle for ensuring low cost debt is to allow increased equity.

In setting equity ratios, the AUC applied its prior method in determining minimum equity ratios needed to satisfy all three credit metrics set out above. In examining updated data in respect of each credit metric, the AUC determined the minimum (and maximum) equity ratios for each credit metric, as follows:

(a) EBIT coverage of 2.0 requires a minimum equity ratio of 33%;

(b) FFO coverage of 3.11 requires a minimum equity ratio of 33%; and

(c) FFO/debt percentages of 11.29 and 14.32 percent require a minimum equity ratio of 34%, and allows for a maximum equity ratio of 43%.

In considering that these updated requirements were somewhat lower than those approved in Decision 2011-474, the AUC held that a reduction of one percent for distribution companies (prior to company specific adjustments) was warranted, and was also sufficient for companies to maintain an A-range credit rating for an average risk utility. For tax exempt utilities, the AUC determined that a continuation of adding two percentage points to the equity ratio of non-taxable utilities and to FortisAlberta (who does not collect income taxes in its revenue requirements) was reasonable.

On company specific matters, ATCO Pipelines argued its risks had increased since the last GCOC proceeding, owing to its integration with NOVA Gas Transmission Ltd. (“NGTL”), and requested a 6.5 percent increase to its equity ratio. CAPP disagreed with ATCO Pipelines’ request, noting that ATCO Pipelines’ revenue requirement was now being recovered as a monthly charge in NGTL’s tolls, and functionally had the same risk level as NGTL’s junior subordinated debt, which CAPP submitted was quite low. CAPP therefore submitted that the increase to ATCO Pipelines’ equity ratio was not needed.

The AUC held that ATCO Pipelines’ risk had not changed since Decision 2011-474. While the AUC acknowledged that some costs may not be recovered through the AUC, this was acknowledged as a risk common to all utilities, and was not unique to ATCO Pipelines. The AUC determined that no changes were necessary to ATCO Pipelines’ equity ratio relative to the other utilities in the GCOC proceeding.

Approved Equity Ratios

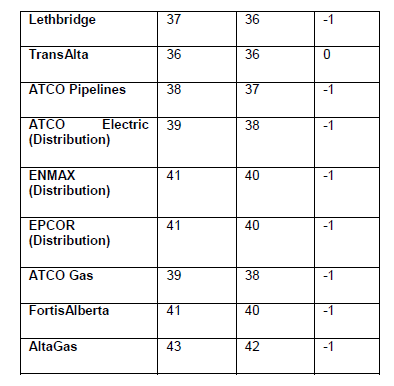

The AUC determined that the equity ratios for each of the utilities be approved at the following levels, finding that no company specific changes were required, save for a one percentage point increase to TransAlta (which effectively maintained their equity ratio at 36 percent):

The AUC noted that these equity ratios were approved on a final basis for 2013 through 2015 and would also remain in place on an interim basis for 2016 and subsequent years, until changed by the AUC.

Accordingly, the AUC directed the Alberta Utilities to adjust their rates to implement the findings of this decision.