Rates – Z Factor – Performance Based Regulation

ATCO Gas and Pipelines Ltd. (“ATCO”) applied to the AUC to recover $5.662 million through a Z factor rate adjustment to compensate ATCO for costs incurred as a result of the 2013 Southern Alberta flood. ATCO stated that its proposed adjustments were comprised of the following:

-

Revenue requirement amounts totalling $2.461 million for capital assets replaced over five years ($75,000 for 2013; $379,000 for 2014; $660,000 for 2015, $682,000 for 2016, and $665,000 for 2017);

-

Operations and maintenance costs totalling $2.951 million, including lost revenues; and

-

$250,000 in carrying costs.

ATCO also sought approval to true up its Z factor costs to actuals each year once the actual costs are known.

The Z Factor is a part of the performance based regulation (“PBR”). The PBR framework, as described in other decisions by the AUC, provides a formula mechanism for the annual adjustment of rates over a five year term. In general, the companies’ rates are adjusted annually by means of an indexing mechanism that tracks the rate of inflation (“I Factor”) relevant to the prices of inputs less an offset (“X Factor”) to reflect productivity improvements that the companies can be expected to achieve during the PBR plan period. The resultant I-X mechanism breaks the linkages of a utility’s revenues and costs in a traditional cost-of-service model. The PBR framework allows a company to manage its business with the revenues provided for in the indexing mechanism and is intended to create efficiency incentives similar to those in competitive markets.

However, certain items may be adjusted for necessary capital expenditures (“K Factor”), flow through costs (“Y Factor”), or material exogenous events for which the company has no other reasonable cost control or recovery mechanism in its PBR plan (“Z Factor”).

The AUC in this decision, noted that the Z Factor can be used to deal with significant events outside the company’s control, such as floods or ice storms, which are not reflected in the inflation factor.

The AUC noted that the criteria applied for a Z Factor are as follows:

-

The impact must be attributable to some event outside management’s control.

-

The impact of the event must be material. It must have a significant influence on the operation of the company, otherwise the impact should be expensed or recognized as income, in the normal course of business.

-

The impact of the event should not have a significant influence on the inflation factor in the PBR formulas.

-

All costs claimed as an exogenous adjustment must be prudently incurred.

-

The impact of the event was unforeseen.

(Collectively, the “Z Factor Criteria”.)

The AUC noted that all of the Z Factor Criteria must be met in order to qualify for a rate adjustment.

ATCO submitted that the flooding in 2013 damaged portions of ATCO’s distribution system, and submitted that its flood response plan consisted of three phases: 1) initial emergency response; 2) damage assessment; and 3) repair and restoration.

ATCO stated that in phase one, it was required in a number of instances to shut off customer service, resulting in lost delivery revenue, totalling $292,617 during the June 20, 2013 to December 31, 2013 period.

ATCO submitted that the bulk of the costs were capital related, and occurred in phase three, including installing new mains which were washed out, and replacing meters, stations and other service lines.

The AUC determined that, of the Z Factor Criteria, the 2013 Southern Alberta Floods were an unforeseen event outside of ATCO’s control, and that the impact of the event did not have a significant influence on the inflation factor in the PBR formula.

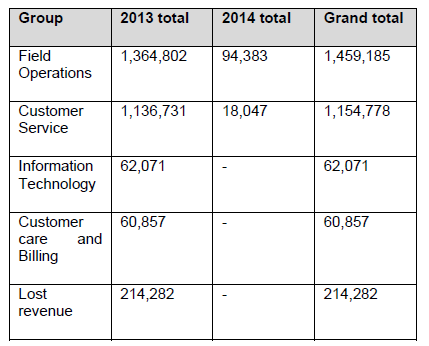

ATCO itemized its costs for the Z Factor application by category, not by phase, as follows:

The AUC held that ATCO incurred $1.46 million in field operations costs due to the vast area affected by the flood, and the wide range of services required to repair its assets. The AUC also held that ATCO incurred $1.15 million in customer service related costs, to ensure that gas was being safely delivered to customers’ homes, which necessitated a large number of site visits. The AUC held that it was persuaded by the evidence that ATCO responded to the flood in a measured and staged approach, and that ATCO diligently returned service to its customers in a reasonable amount of time. The AUC considered that given the scope and timing of the activities to restore service to pre-flood levels, the expenditures for operations and maintenance costs incurred were prudent.

With respect to ATCO’s capital costs incurred in response to the 2013 flood events, the AUC noted that ATCO completed nearly 90 percent of its infrastructure repair and replacement by the end of 2014, finding that the scope of work performed, the timing of the repair and replacement activities, and the quantum of such costs to be reasonable. The AUC accordingly held that the capital costs incurred by ATCO in response to the 2013 flood events were prudently incurred.

With respect to lost revenue, the Utilities Consumer Advocate (“UCA”) argued that ATCO’s claim for $214,282 in lost revenue was not appropriate, as it should have qualified under ATCO’s terms and conditions as a force majeure. Accordingly, the UCA argued that ATCO would have been permitted the interruption or reduction in service during the event. The UCA also submitted that ATCO did not file any evidence that ratepayers were unable or unwilling to pay their bills during this period.

ATCO replied, stating that the PBR regime does not limit a company from recovering costs beyond operating and capital costs, but rather the total impact of an exogenous event may be recovered. ATCO also submitted that invoking the force majeure clause would not have resulted in savings to customers, nor would it have had an impact on its Z Factor claim, since any claim would be collected from customers in any event.

The AUC determined that ATCO was still performing its duties as a utility service provider at the time of the flooding event, and that invoking force majeure with its retailers would not have resulted in any savings to consumers. Accordingly, the AUC accepted ATCO’s evidence that it lost $214,282 of revenue due to the flood event, and held that the lost revenue amount claimed by ATCO was eligible for inclusion in the calculation of the Z Factor materiality threshold.

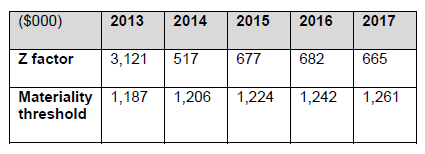

The AUC noted that the Z Factor materiality threshold was established in Decision 2012-237 as the dollar value of a 40 basis point change in after tax return on equity, calculated using the company’s equity for 2012 going-in rates, and adjusted annually by the I-X mechanism.

ATCO submitted that its 2013 materiality threshold was $1.187 million, which was approved in ATCO’s 2013 capital tracker true-up application for the purposes of its K Factor.

The UCA opposed ATCO’s approach to utilizing only 2013 as a Z Factor threshold.. The UCA noted that ATCO was in effect applying its Z Factor costs for up to 5 years against a single year for materiality purposes. The UCA submitted that in a similar manner to K Factor calculations for multi-year capital projects, the materiality threshold is applied annually to the incremental revenue requirement determined by the applicable accounting test. The UCA submitted that, in comparing the materiality amounts for 2013 through 2017 against the costs claimed by ATCO, that only costs for 2013 met the 40 basis point test.

The Consumers’ Coalition of Alberta (“CCA”) argued that a single year materiality value was inappropriate, and recommended that the AUC apply an arithmetic average of the annual materiality thresholds over the period in question, and assess the materiality of the entire Z Factor adjustment amount. The CCA submitted that this approach may help to assess costs of a one-time event having an impact over a multi-year period.

The AUC held that Z factor materiality threshold was to apply on an annual basis, since the I-X mechanism and return on equity values are similarly calculated and adjusted annually. Therefore, in applying the Z Factor threshold for 2013, the AUC held that ATCO’s costs of $3.121 million for 2013 exceeded the materiality threshold of $1.187 million. The AUC determined that the $3.121 million was broken down as follows:

-

$75,000 for revenue requirement and capital expenditures;

-

$2.389 million for operations and maintenance costs and lost revenue; and

-

$207,000 in carrying costs.

However, for the years, 2014 to 2017 the AUC determined that ATCO’s costs did not satisfy the materiality threshold for Z Factor treatment, as shown in the table below:

Therefore, the AUC declined to award Z Factor treatment to costs incurred between 2014 and 2017. However, with respect to capital costs incurred over this period, the AUC noted that its determination did not preclude ATCO from bringing forward an application for these costs by way of a K Factor application, provided the costs satisfy the applicable criteria.

With respect to depreciation matters, the AUC held that the characteristics of the 2013 flood event were similar in nature to the 2005 Southern Alberta flood event, and that those effects were accounted for in ATCO’s last depreciation study in 2009. Therefore the AUC concluded that the 2013 flood did not give rise to an extraordinary retirement of destroyed assets, and that accordingly, the undepreciated net book value of $496,747 would continue to be recovered from ratepayers.

The AUC therefore approved a Z Factor to ATCO in the amount of $3.121 million for the 2013 Southern Alberta Flood event.