Performance-Based Regulation Rate Adjustment

AltaGas Utilities Inc. (“AltaGas”) filed its 2016 annual performance-based regulation (“PBR”) rate adjustment filing, and requested approval of its distribution rates and special charges schedule effective January 1, 2016 on an interim basis.

(See the EPCOR Distribution & Transmission Inc. case in this report regarding the PBR framework, as described by the AUC.)

AltaGas’ PBR rates were originally approved in Decision 2012-237, Decision 2013-465 and Decision 2014-357.

2016 Updates to I Factor and I-X Mechanism

As part of AltaGas’ submissions, it filed an update to its I Factor of 2.06 percent based on data vector v79311387 from Statistics Canada Table 281-0063 to calculate Alberta average weekly earnings figures, as the previous Statistics Canada tables had been terminated. Together with AltaGas’ X Factor of 1.16 percent approved in Decision 2012-237, AltaGas requested approval of its I-X index value of 0.90 percent for 2016.

With the exception of the escalation of costs under the I-X mechanism, AltaGas proposed no other changes to its terms and conditions of service.

No parties objected to AltaGas’ updated calculations, and the AUC approved AltaGas’ 2016 I Factor and resulting I-X mechanism for 2016 as filed, finding the calculations to be reasonable.

Y Factor

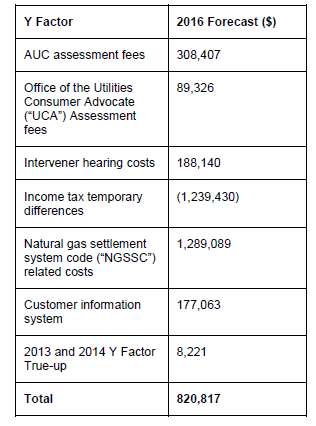

AltaGas requested the following 2016 Y Factor amounts:

AltaGas submitted that it’s forecasted AUC assessment fees were indexed using the I-X mechanism for 2016. The UCA assessment fees were, in AltaGas’ submission, based on the most recent Ministerial Order covering the fiscal period from April 1, 2013 to March 31, 2014, and adjusted by the I-X mechanism for 2016. AltaGas submitted that it expected to make further adjustments to the UCA assessment fees once it receives the Ministerial Order for the fiscal period April 1, 2014 to March 31, 2015.

With respect to intervener hearing costs, AltaGas submitted that its forecast amount for 2016 was based on “a combination of professional judgment and AUC cost awards for similar proceedings.”

With respect to income tax temporary differences, AltaGas submitted that the credit for 2016 is largely due to differences between tax and book depreciation, as well as items capitalized for book purposes.

AltaGas forecasted its NGSSC revenue requirements in three parts:

(a) Phase 1 capital-related costs of $377,028;

(b) Phase 2 capital-related costs of $568,361; and

(c) Operating costs of $343,700.

AltaGas also noted that its 2016 forecast operating costs are lower than 2015 costs as a result of lower contracted application support services as a result of transitioning to internal AltaGas resources for routine technical maintenance and operational support.

AltaGas explained that the customer information system costs were a Y Factor cost as such costs are outside AltaGas’ management’s control, since such costs are driven by the AUC’s direction pursuant to Rule 004 and Rule 028, and would exceed the materiality threshold of $325,000 established in Decision 2012-237.

After review, the AUC determined that AltaGas’ requested Y Factor amounts for 2016 for AUC assessment fees, UCA assessment fees, intervener hearing costs and income tax temporary differences were reasonable and consistent with methodologies used in previous PBR annual filings. Accordingly, the AUC approved AltaGas’ 2016 Y Factor amounts for these costs as filed, totalling $643,754.

With respect to customer information system costs, the AUC noted AltaGas applied for an exemption from compliance with the NGSSC requirements of Rule 004 and Rule 028. The AUC also noted that while the applied-for exemptions were granted in Decision 3606-D01-2015 and Decision 20428-D01-2015, the AUC did not make a specific direction for AltaGas to correct the noncompliances, but rather to provide updates on its progress to become compliant.

Accordingly, the AUC determined that the customer information system costs requested by AltaGas for 2016 were not events outside of management’s control, and that there was insufficient evidence on the record to determine the prudence of such costs. Therefore the AUC denied $177,063 of 2016 NGSSC customer information system costs from AltaGas’ requested Y Factor.

K Factor Placeholder

AltaGas requested a K Factor placeholder in the amount of $4.86 million for 2016. The K Factor, in AltaGas’ submission was composed of two components:

(a) A 90 percent placeholder of $5.27 million for AltaGas’ 2016-2017 forecast PBR capital tracker application of $5.85 million; and

(b) A 2014 K Factor true-up refund of $393,854, and a 2013 K Factor refund of $11,217.

AltaGas noted that the 2013 figures account for pipeline replacement costs that were denied in Decision 2014-373, and reapplied for later. AltaGas also noted that its 2014 K Factor adjustments were the result of actual capital additions being six percent lower than forecast.

There were no objections to AltaGas’ 2016 K Factor placeholder.

The AUC approved the 90 percent proposed K Factor placeholder as filed, noting that the forecast placeholder provides a reasonable level of funding and reduces the potential for customer rate shock in future proceedings.

Financial Reporting Requirements

As directed by the AUC in Decision 2012-237, AltaGas submitted a copy of its Rule 005: Annual Reporting Requirements of Financial and Operational Results (“Rule 005”) filing, which included among other items the equity thickness, return on equity figures and a confirmation that the assumptions and calculations in the application were accurate and complete.

The Consumers’ Coalition of Alberta (“CCA”) raised concerns whether AltaGas had applied the correct equity thickness for its return on equity percentages in 2013 and 2014, submitting that AltaGas used blended equity thickness ratios of 42.83 and 42.77 percent respectively. The CCA noted that the blended ratios arose from AltaGas applying 43 percent equity to PBR rate base excluding Y and K Factors, and 42 percent PBR rate base to Y and K Factors. The CCA submitted that the correct equity thickness for 2013 and 2014 was 42 percent, based on the AUC’s direction in Decision 2191-D01-2015, which dealt with generic cost of capital matters.

The AUC determined that AltaGas’ Rule 005 filing was compliant with its direction in Decision 2012-237. However, with respect to the CCA’s concerns regarding equity thickness, the AUC noted that similar issues have arisen in the 2016 PBR rate adjustment filings for other companies, and that the AUC will be releasing a separate communication clarifying reporting requirements.

Accordingly, the AUC declined to rule on this specific issue in the decision.

2016 Billing Determinants and Rate Riders

AltaGas submitted that it made no changes to the methods used to calculate its forecast billing determinants. There were no objections to AltaGas’ proposed 2016 billing determinants.

The AUC approved AltaGas’ proposed 2016 billing determinants as filed. The AUC directed AltaGas to provide information concerning any variances from forecast to actual by rate class, and directed AltaGas to identify the causes of variances in billing determinants that exceed ± 5 percent in its next PBR filing.

With respect to rate riders, AltaGas proposed no changes to its existing nine rate riders for:

(a) Franchise fees;

(b) Property tax;

(c) Deemed cost of gas;

(d) Gas cost recovery;

(e) Unaccounted-for gas;

(f) Deficiency or refund from interim rates;

(g) Third-party transportation costs;

(h) Default gas supply providers’ unaccounted-for gas; and

(i) Load balancing.

There were no objections to AltaGas’ continued use of rate riders.

The AUC approved each of the nine rate riders, finding that each rider was necessary to address flow-through or Commission-directed items. The AUC noted that it will reassess the continuing need for rate riders at the time of AltaGas’ next PBR rate adjustment filing.

Rates and Bill Impacts

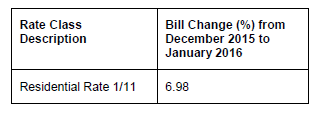

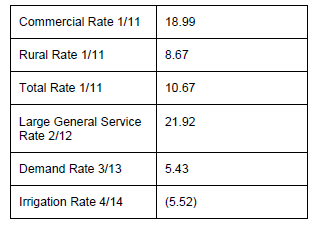

AltaGas submitted that the bill impacts for the proposed 2016 distribution rates would be as follows:

AltaGas noted that the overall rate impacts for 1/11 and 2/12 rate classes was more than 10 percent, while the overall rate impacts for 3/13 and 4/14 rate classes were below 10 percent. AltaGas explained that approximately half of the increase for 1/11 and 2/12 rate classes were attributable to increased forecast delivery revenues for December 2015 and January 2016.

The AUC held that while it considers 10 percent to be a threshold that is indicative of rate shock, it accepted AltaGas’ explanation, and noted that when the bills for 1/11 and 2/12 rate classes are normalized for usage and commodity costs, the bill impacts are below 10 percent. The AUC determined that the bill impacts would therefore not cause rate shock to consumers.

The AUC noted that the 2016 rates reflect the inclusion of a 90 percent K Factor placeholder, and that rates are interim until approved on a final basis by the AUC.

As a result of the above findings, the AUC ordered that the distribution rates and special charges contained in Appendix 4 and Appendix 5 of this decision be approved on an interim basis effective January 1, 2016.