Tariff – Rates – Revenue Requirement

ATCO Pipelines, a division of ATCO Gas and Pipelines Ltd. (“ATCO”) applied for approval for its forecast revenues of $214,728,000 for 2015 and $250,362,000 for 2016. ATCO later updated its applied-for revenue requirements as follows:

-

$210,233,000 for 2015; and

-

$245,472,000 for 2016.

ATCO’s previously approved interim revenue requirement was $17,157,800 per month, or $205,893,600 per year, representing 60 percent of ATCO’s requested increase for its 2015 revenue requirement.

The updated applied for revenue requirement represented an overall reduction of $9,385,000 over the test period applied for, resulting primarily from the following factors:

-

Decision 2191-D01-2015, being the generic cost of capital proceeding, which reduced ATCO’s equity ratio from 38 to 37 percent, and reduced the return on equity to 8.30 percent from 8.75 percent for 2015;

-

Decision 19756-D01-2015, which denied the House Mountain project.

-

Reductions to ATCO’s forecast Urban Pipeline Replacement (“UPR”) program; and

-

Other reductions and adjustments to rate base and expenses, largely as a result of when certain projects went into service, and subsequent depreciation revisions.

ATCO explained that the revenue requirement would be collected from NOVA Gas Transmission Ltd. (“NGTL”) according to the terms of the integration between the two pipeline systems owned by NGTL and ATCO.

ATCO also sought approval from the AUC for:

-

Forecast opening balances for plant, property and equipment (“PP&E”) as at January 1, 2015;

-

Continued use of deferral accounts and placeholders;

-

Proposed depreciation rate changes; and

-

Proposed settlement of certain regulatory deferral accounts.

Rate Base

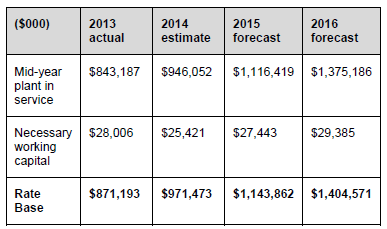

ATCO’s requested rate base was applied for as follows:

The AUC held that ATCO’s requested rate base was reasonably calculated. However, the AUC found that, in reviewing ATCO’s revised revenue requirement, some financial schedules did not align with the initial applied for amounts. The AUC therefore directed ATCO, in its compliance filing, to provide a confirmation to the AUC that the financial schedules were consistent with the revised information.

Capital Expenditures

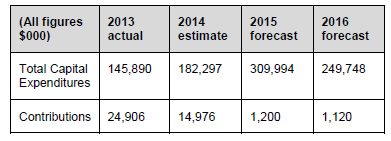

ATCO included the following figures for its forecast capital expenditures over 2015 and 2016, as well as actuals and estimates for 2013 and 2014 as follows:

ATCO noted that the growth in capital expenditures were largely driven by growth in NGTL’s FT-D2 delivery service, largely in the Alberta industrial heartland, and FT-D3 utility delivery service for companies in ATCO’s service area.

Interveners, including the Consumers’ Coalition of Alberta (“CCA”) and Utilities Consumer Advocate (“UCA”) expressed concerns with the quality of ATCO’s business cases. The CCA and UCA noted deficiencies in the business cases, such as a lack of explanations of need, timing, and a lack of a cost-benefit analysis.

The UCA recommended that ATCO should demonstrate a case for the following three criteria, in submitting capital costs for inclusion in rates:

-

that, in the absence of the capital expenditure, service quality and safety would deteriorate;

-

why the project timing is optimal, and that the project could not be deferred; and

-

a comparison of the project costs of similar projects over the last five year period for each project.

ATCO argued that the interveners placed undue reliance on the requirement for a quantitative cost-benefit analysis. ATCO also submitted that the UCA improperly proposed the application of entirely new business criteria, giving the appearance that the traditional business case criteria were inadequate.

ATCO submitted that its business cases continued to comply with the AUC’s directives in Decision 2000-9, which required the following information for major capital projects:

-

A detailed justification, including demand, energy and supply information;

-

A breakdown of the proposed cost;

-

Options considered and their economics; and

-

The need for the project.

The City of Calgary argued that ATCO Pipelines had not followed previous business case directives from the AUC in Decision 2000-9, and did not discharge its onus to show that the expenditures were necessary. Accordingly, the City of Calgary recommended that the AUC disallow ATCO’s requested costs for project which did not meet these requirements.

ATCO also pointed to Decision 3539-D01-2015, wherein the AUC held that the exact criteria proposed by the UCA were rejected, noting the further volume and complexity that would be added to rate proceedings.

The AUC held that the additional criteria proposed by the UCA were similar to performance-based regulation criteria, and should not apply to the cost-of-service regulation context, consistent with Decision 3539-D01-2015.

The AUC, in providing its findings on this point, expanded on the four criteria set out in Decision 2000-9 as follows:

-

The detailed justification should include an overall requirement for the project, how the project fits into the existing infrastructure, and any drivers of the project;

-

The breakdown of costs should also include an estimation of new operational expenses as a result of the capital cost expense, if the project is put into rate base before the end of the test period;

-

The options considered should include a discussion to support a cost-benefit analysis for the preferred alternative, and provide a clear rationale for the preferred alternative; and

-

The need for the project should include the rational of need for the project as outlined under Rule 020: Rules Respecting Gas Utility Pipelines, including information as to the growth, replacement, improvement, safety, quality of service, or some combination thereof, as well as an estimate of timing for the project.

The AUC held that ATCO’s business cases lacked relevant information, including the costs for project alternatives and impacts on operating costs. Despite this finding, the AUC held that it was not prepared to apply a general reduction to ATCO’s forecast, citing its findings related to specific capital projects, and capital expenditure forecasting accuracy in this decision.

Capital Forecasting Accuracy

The Canadian Association of Petroleum Producers (“CAPP”) argued that ATCO had not demonstrated the ability to accurately forecast capital expenditures, noting prior variances of $1.2 million and $47.4 million for 2013 and 2014 respectively. CAPP noted that ATCO significantly over-forecasted capital expenditures over the last four year period, creating excess rates of return on equity for actual capital expenditures. CAPP submitted that since 2010, ATCO’s actual return on equity has been between 1.08 to 2.78 percent above the approved ROE, due in part to over-forecasted capital expenditures. CAPP proposed that the capital expenditures be treated on an “actual” or annual deferral account basis. The UCA made similar submissions supportive of CAPP’s general position on this issue.

ATCO argued that it was on target with its necessary applied-for capital work for the 2013-2014 test period, based on its most recent figures. ATCO disagreed that any capital reduction, let alone an arbitrary general reduction was warranted, submitting that ATCO had a good record of forecasting capital expenditures and improving trends in this regard.

The AUC held that the evidence demonstrated ATCO having a history of over-forecasting capital expenditures and capital additions. Therefore an adjustment to forecast capital expenditures was reasonable in the circumstances for certain categories of capital expense.

For replacement and improvement capital expenditures, the AUC directed ATCO to reduce its forecast by 10 percent, given the historical information on forecast variances.

The AUC rejected CAPP’s proposal for deferral treatment, however holding that capital expenditures are best examined on a forecast, prospective basis. The AUC noted that, if capital expenditures were subject to deferral accounts, no incentive would exist for ATCO to manage its forecast capital costs.

The AUC held that no adjustments were necessary for ATCO’s UPR program or any NGTL directed growth capital expenditures. The AUC did however voice its concern with the lack of transparency and confidential nature of NGTL’s approval for UPR projects, calling it a serious concern. The AUC therefore directed ATCO to provide more detailed information to support the hydraulic analysis, technical and financial justification for its pipeline projects, including NGTL’s rationale for its approvals.

However, due to a number of re-bids on UPR projects, and noting a number of reductions, ATCO also proposed a deferral account to provide benefits to customers from future tenders below the original forecast.

Both the UCA and CAPP supported the use of a deferral account for UPR projects.

The AUC approved the use of the deferral account for UPR projects, and directed ATCO to provide an update on its efforts to reduce UPR capital costs in its compliance filings, as well as the actual costs for projects in the 2015 test year.

Any forecast capital expenditures not specifically noted by the AUC were approved as filed.

UPR Procurement Process

The AUC noted that the UPR capital forecast costs increased from approximately $369 million to $600 million over a three year period. The UCA submitted that the competitive bid process did not result in competitive pricing, despite flat labour and material costs, since the bid process times were shortened, and that the tendering process was confusing.

ATCO proposed its above noted deferral account to remedy the UCA’s concerns. ATCO also argued that the bid process was robust, with good depth of qualified bidders.

The AUC held that ATCO’s bid process was reasonably competitive, and had a sufficient number of bidders. However, the AUC agreed with the UCA, finding that the cost increases were significant and material to customers. Therefore the AUC reiterated its finding approving the deferral account treatment to UPR capital expenditures in the test period, which will afford parties an opportunity to provide submissions on the costs to be recovered related to the procurement process.

Inland Looping Project

ATCO proposed the construction of the Inland Looping Project, which is approximately 26.7 kilometers of 508 millimeter pipeline, looping the Inland transmission system from the western end of the Norma transmission to the junction of the Inland Wye system. ATCO estimated the cost at approximately $52 million with an in-service date of November 2016.

However, ATCO, in response to an information request, noted that NGTL no longer supported the full Inland Looping Project, but only 18 kilometers of the project, at a reduced cost of $40 million due to changes in forecast supply and demand on the Alberta system.

None of the interveners opposed the inclusion of the Inland Looping Project.

The AUC held that the Inland Looping Project was approved for inclusion in the NGTL directed growth capital deferral account.

H2S Warning Lights at 45 stations

ATCO applied for inclusion of $685,000 in forecast costs for installation of a standard hydrogen sulfide (“H2S”) warning light and horn system at 45 stations that may receive gas containing H2S.

The CCA submitted that ATCO’s business case had not confirmed the contractual status of any of the 45 stations, and incorrectly included eight stations that were the subject of an asset swap with NGTL.

The AUC held that ATCO’s business case was acceptable, but did not directly address the CCA’s concerns. ATCO’s testimony revealed that there was doubt as to whether there was a need to upgrade all of the stations in the test years. The AUC accordingly reduced the forecast estimate by the average station cost for eight stations, resulting in a disallowance of $180,444 split between the two test years. The AUC directed ATCO to reflect this reduction in its compliance filing.

Edmonton Office Expansion

ATCO proposed to construct an expansion to its existing ATCO Pipelines Edmonton Centre (“APEC”), adding 75 workstations to accommodate the increased number of permanent office employees in Edmonton, at a cost of $8.5 million.

ATCO argued that the 40-year cumulative net present value cost of service alternative for a lease was calculated at $12,743,000 for similar service.

The CCA disagreed with ATCO’s projections, noting that a 40 year period was too long to predict the need for staff. The CCA therefore requested an updated forecast of office space needs for expected full-time equivalents in its compliance filing.

The AUC accepted ATCO’s argument that the construction of new space would provide a lower cost of service than leasing new space. However, in light of recent announcements of staffing reductions, ATCO was directed to file an update to its APEC business case in its compliance filing.

Asset Management Projects

ATCO filed for inclusion of the following asset management program costs in the test period:

-

Maximo Phase 2;

-

Hyperion; and

-

Enchancements to Geographic Information System (“GIS”), Pipelines Integrity Management System (“PIMS”) and Maintenance Management System (“MMS”).

ATCO stated that the Maximo software is intended to automate time entry, and become a central repository for pipeline and facility maintenance data. The total cost of Maximo Phase 2 was estimated at $1,250,000. The Hyperion budgeting and planning system would support budgeting and forecasting, the development of regulatory applications and modelling and simulation abilities. The total cost of Hyperion implementation was estimated at $1,600,000 with $150,000 in annual costs.

ATCO submitted that the GIS, PIMS and MMS projects did not exceed the $500,000 threshold for business cases, and therefore provided detail as requested through the information request process. ATCO noted that the forecast expenditure for GIS, PIMS and MMS over the forecast period was equal to approximately $3.35 million.

The City of Calgary submitted that ATCO’s asset management expenditures were approximately $5.0 million, and were not supported by a quantification of benefits to consumers. Calgary therefore recommended that the AUC disallow $4.95 million in forecast asset management capital costs, as follows:

-

Maximo Phase 2 – $0.75 million;

-

GIS, PIMS, MMS enhancements – $2.6 million; and

-

Hyperion – $1.6 million.

The CCA took issue with ATCO’s subdivision of projects into smaller pieces for what it referred to as avoiding their consideration in a larger business case. Accordingly, the CCA requested that the smaller projects be excluded from rate base as a result of ATCO not properly documenting the need for these projects.

The AUC held that the GIS, PIMS and MMS enhancements, while below the $500,000 threshold, represented significant amounts over the test period, when considered in aggregate. The AUC also agreed with the City of Calgary that ATCO failed to provide a cost-benefit analysis related to its Maximo Phase 2 and Hyperiod projects. The AUC denied ATCO’s costs for these three asset management projects, and directed ATCO to remove $4.95 million worth of capital expenditures from the test years.

NGTL Asset Transfer

The AUC noted that ATCO had entered into an agreement with NGTL to transfer approximately 393 pipeline segments totalling 1,249 km in length to NGTL, and to receive approximately 171 pipeline segments totalling 1,440 km in length from NGTL, as well as approximately 85 meter stations and one compressor station. ATCO submitted that the net effect of the asset swap would be a cumulative savings of approximately $34 million, including operations and maintenance costs over the test period. However, ATCO noted that these amounts would be offset by NGTL savings, resulting in a minimal net effect on the Alberta system cost of service. ATCO submitted that any true-up would be captured through the NGTL integration deferral account. In all, ATCO submitted that the impact of the asset swap would be a net cost of $2.2 million to ATCO due to higher land rights payments being transferred, as well as the cost of the additional metering stations.

The AUC held that the one-time capital, one-time operations and maintenance costs, and annual operations and maintenance costs were reasonable. The AUC stated it was cognizant that some one-time costs are necessary for asset transfers, and approved each set of costs as filed. The AUC also approved a placeholder amount of zero, noting that any true up would be captured under the NGTL integration deferral account in a future proceeding.

Necessary Working Capital

ATCO did not propose any material changes to the lead-lag days approved in its previous 2013-2014 general rate application. However, ATCO did request that the AUC approve the removal of deferral account balances from the calculation of necessary working capital, and instead allow the accrual of carrying costs on approved deferral accounts on a monthly basis.

The UCA recommended an adjustment to the necessary working capital for ATCO to reflect ATCO’s practice of capitalizing capital additions well after mid-year. The UCA explained that capital additions are assumed to occur regularly when capitalized at mid-year, although ATCO often reaches 50 percent capitalization of its capital expenditure in October of each year. That presumption, according to the UCA, underpins a number of rate base calculations used to calculate the utility’s return. Accordingly, the UCA requested that the AUC adjust ATCO’s applied for necessary working capital by $2.8 million in 2015 and $2.9 million in 2016.

ATCO submitted that the UCA’s proposal was not appropriate, and would deviate from the mid-year convention of capitalizing costs.

The AUC determined that the UCA’s proposal was not meant to deviate from the mid-year convention, but would instead adjust the lead-lag study to account for lag days in capital additions owing to the fact that ATCO’s capital additions routinely fall after the mid-year. However, the AUC was not persuaded to revise its calculation of necessary working capital, given the AUC’s recent findings in Decision 3539-D01-2015, where it found that mid-year capitalization is a long-standing convention. In that decision, the AUC also found that additional tracking of lag days would add unnecessary complexity to the calculations.

The AUC therefore approved ATCO’s necessary working capital calculations as filed. However, the AUC directed ATCO to provide a further explanation of why its capital additions lag the mid-year convention, and whether it is appropriate to include the capital additions or other capital related items in the necessary working capital.

Operating Costs

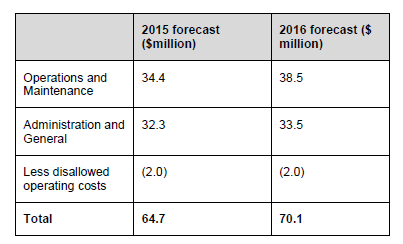

ATCO’s forecast operating costs were stated as follows for the test period:

Each year’s costs, according to ATCO represented 31 and 28 percent of forecast revenue requirement, respectively. ATCO noted that it included a reduction of $2.0 million in each year for costs previously disallowed by the AUC, notably the pension cost of living allowance, and incentive program costs.

ATCO’s operating costs decreased by 31 percent from 2010 to 2014. However, ATCO noted that the requested operating costs for the test period increased in 2015 from 2014 actual values by $6.0 million, or 21 percent. In 2016, the figures increased over 2015 values by $4.2 million, or 12.4 percent.

None of the interveners submitted views on the overall forecast operating costs.

The AUC approved ATCO’s requested operating costs as filed, except where specifically excluded elsewhere in the decision.

Salary Escalators

The CCA submitted that the current Alberta labour market, given the market conditions, did not support ATCO’s requested escalation of 3.5 percent per year for 2015 and 2016 for its unionized labour. ATCO’s current labour agreements include a salary escalator of 3.5 percent for 2014 and 2015, but no agreement has been reached for 2016.

The CCA submitted that the AUC limit labour inflation rates to zero percent for any labour contracts not settled at the time of the hearing. CAPP submitted that any incomplete salary escalators for the test period be subject to deferral account treatment.

The UCA argued that it was disingenuous for ATCO to cut labour costs for the account of its shareholders in claiming a surfeit of labour talent, while simultaneously asking the AUC to approve labour cost increases paid by constumers to retain and attract talent.

ATCO submitted that CAPP’s proposal would not materially affect rates, noting that a one percent adjustment to in-scope salaries would amount to approximately $92,000. ATCO also argued that the UCA was “completely off the mark” with its allegations of disingenuous conduct, as any cost savings from labour costs would be for the account of ratepayers, not shareholders.

The AUC held that a deferral account for 2016 labour escalators was not necessary, finding that any adjustments would not likely meet the materiality criteria for deferral treatment.

However, the AUC reduced ATCO’s requested salary escalator for 2016 from 3.5 percent to 3.0 percent, based on the evidence provided by ATCO respecting current labour market conditions.

For non-union employees, ATCO requested salary escalators of 4.2 percent for 2015 and 2016, based on forecast labour market data. However, during the hearing, ATCO updated these figures to reflect changes in the market. Accordingly, ATCO updated its labour market data for non-union salary escalators to 3.0 percent for 2015 and 2016, but left its requested increase at 4.2 percent. ATCO maintained its requested increase, pointing to the fact that its overall compensation lags the market by 15 percent.

CAPP disagreed with ATCO’s requested non-union labour increases, as CAPP argued that ATCO’s inflation factors were based on unrepresentative averages needed to compensate employees at a competitive level.

The UCA agreed with ATCO’s updated submission on salary escalators, and recommended an increase of 3.0 percent for 2015 and 2016.

The AUC held that the evidence before it did not support a 4.2 percent salary increase for non-union labour, pointing to the evidence presented by ATCO that such labour escalators are trending downward.

The AUC further did not accept ATCO’s rationale that it lagged the market by 15 percent. The AUC noted that, when looking at base salary, ATCO was on average 2 percent above the 50th percentile, and it was not reaonsable to escalate base salaries to balance out its total compensation. The AUC held that there were other means at ATCO’s disposal to manage its total compensation.

The AUC therefore approved a 3.0 percent salary escalation factor for 2015 and 2016 for non-unionized labour, and directed ATCO to reflect this finding in its compliance filing.

Variable Pay Program

ATCO submitted that it implemented a new variable pay program (“VPP”) pursuant to an approval in AUC Decision 2013-430. The VPP, in ATCO’s submission, was based on individual performance and the performance of the employee’s department. ATCO did not forecast an extension of the VPP through 2015-2016, but would continue to monitor and evaluate the need to adjust the VPP as the market dictated.

The CCA argued that there was no VPP paid out in 2014, and consequently requested that the AUC deny ATCO’s forecast VPP amounts for 2015 and 2016.

ATCO replied that it must retain the ability to react to the marketplace to attract and retain employees.

The AUC noted that ATCO acknowledged that any VPP amounts not paid out will be refunded to consumers. Accordingly, the AUC held that the forecast VPP amounts of $2.628 million in 2015 and $2.766 million in 2016 for VPP were reasonable, as any unpaid amounts would be refunded through a variable pay deferral account, which it also approved.

FTE Forecasts

ATCO forecasted an additional 36 FTEs in 2015 and an additional 10 FTEs in 2016. ATCO submitted that total FTEs would be 470 at year end 2015, and 480 at year end 2016.

CAPP requested that any forecast positions currently unfilled be disallowed, and any positions not filled in a timely manner be removed from the forecast FTEs in the test period.

The CCA took issue with ATCO’s announcement in late 2015 that it would be reducing staff, but not placed on the record by ATCO. The CCA submitted that the compliance filing must include information on the effects of restructuring within ATCO.

The AUC directed ATCO to clearly identify the impact of announced employee reductions on forecast FTEs and revenue requirement. Accordingly, the AUC approved the FTE costs on a placeholder basis until the impact of the reductions is tested in the compliance filing.

Return on Rate Base

ATCO requested a return on equity of 8.30 percent for 2015, with a capital structure of 37 percent equity and 63 percent debt for 2015. ATCO requested that the same return on equity and capital structure be approved on a placeholder basis for 2016, since the AUC’s most recent generic cost of capital decision 2191-D01-2015 applies only to the 2015 test year.

The AUC approved ATCO’s requested return on equity and capital structure as filed, noting that the figures were compliant with Decision 2191-D01-2015.

Debt Rate

ATCO requested a cost of debt equal to 4.00 percent for 2015 and 4.65 percent for 2016.

The CCA recommended that the AUC apply ATCO’s most recently obtained rate for a debenture offering, at 3.964 percent, and further recommended a 2016 forecast debt rate of 3.99 percent, based on 10-30 year bond differentials, ATCO’s credit spread, and the consensus forecast for 10 year bond rates.

The AUC approved ATCO’s 2015 debt rate at 3.964 percent holding that, since the actual cost of debt for 2015 was known, it would apply actual data where available over forecast data.

For ATCO’s 2016 debt rate, the AUC approved a debt rate of 4.29 percent. The 10-30 year bond differential raised by the CCA created an “implied long Canada bond rate” of 2.49 percent, which was 0.66 percent lower than ATCO’s forecast long Canada bond rate of 3.15 percent, which was offset by ATCO’s updated credit spread of 180 basis points. Accordingly, the AUC approved the 4.29 percent debt rate for 2016 on a final basis.

Deferral Accounts

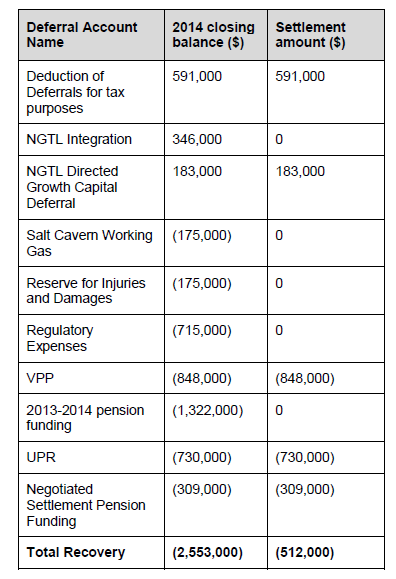

ATCO requested that the AUC approve the following deferral accounts for the test period:

The AUC approved the amounts in the table above, as filed, with the exception of regulatory expenses and regulatory or legislative changes.

CAPP recommended that, for the regulatory expenses deferral account, that ATCO’s hearing costs and AUC operating costs be settled simultaneously when combining both categories of expenses.

The AUC agreed, holding that settling both cost categories would assist the AUC in tracking costs included in the deferral account on a go-forward basis.

ATCO requested the continued use of its regulatory or legislative changes deferral account to provide protection from the impact of changes to legislation that may arise during the test period.

The AUC denied ATCO’s request, holding that there was no evidence with regard to a forecast amount expected during the test period, nor was there any evidence addressing the uncertainty or inability to forecast the amounts needed. While the AUC noted that such changes are beyond the control of ATCO, the AUC held that such changes are typically made with advance consultation with stakeholders, and that changes typically take time to implement.

Depreciation

ATCO included a technical update to its last depreciation study in the application. ATCO provide updated depreciation rates for 2015 and 2016 test years based on plant in service balances, as of December 31, 2013. ATCO submitted the effect of the updated amortization was an increase in depreciation expense at $1.39 million.

The AUC accepted ATCO’s evidence, and approved the updated forecast depreciation rates as reasonable.

Order

The AUC directed ATCO to submit a compliance filing no later than April 14, 2016.