Rates – True-Up – Capital Tracker

ATCO Gas and Pipelines Ltd. (“ATCO”) applied for approval of its 2014 capital tracker true-up and 2016-2017 capital tracker forecast under performance-based regulation (“PBR”).

The PBR framework, as described by the AUC, provides a formula mechanism for the annual adjustment of rates over a five year term. In general, the companies’ rates are adjusted annually by means of an indexing mechanism that tracks the rate of inflation (“I Factor”) relevant to the prices of inputs less an offset (“X Factor”) to reflect productivity improvements that the companies can be expected to achieve during the PBR plan period. The resultant I-X mechanism breaks the linkages of a utility’s revenues and costs in a traditional cost-of-service model. The PBR framework allows a company to manage its business with the revenues provided for in the indexing mechanism and is intended to create efficiency incentives similar to those in competitive markets.

However, certain items may be adjusted for necessary capital expenditures (“K Factor”), flow through costs (“Y Factor”), or material exogenous events for which the company has no other reasonable cost control or recovery mechanism in its PBR plan (“Z Factor”).

This supplemental funding mechanism was referred to in Decision 2012-237 as a “capital tracker” with the revenue requirement associated with approved amounts to be collected from ratepayers by way of a K Factor adjustment to the annual PBR rate setting formula.

In order to receive capital tracker treatment under PBR, a capital project or program must meet the following three criteria established in Decision 2012-237:

-

The project must be outside of the normal course of the company’s ongoing operations (“Criterion 1”);

-

Ordinarily the project must be for replacement of existing capital assets or undertaking the project must be required by an external party (“Criterion 2”); and

-

The project must have a material effect on the company’s finances (“Criterion 3”).

The AUC had previously approved ATCO’s K Factor placeholders on an interim basis in the amount of $13.196 million for ATCO’s 2014 PBR rates. The AUC also later approved ATCO’s 2015 K Factor placeholders on an interim basis in the amount of $34.95 million for 2015, and directed ATCO to include a K Factor placeholder in its 2016 PBR rates equal to 90 percent of the proposed 2016 K Factor.

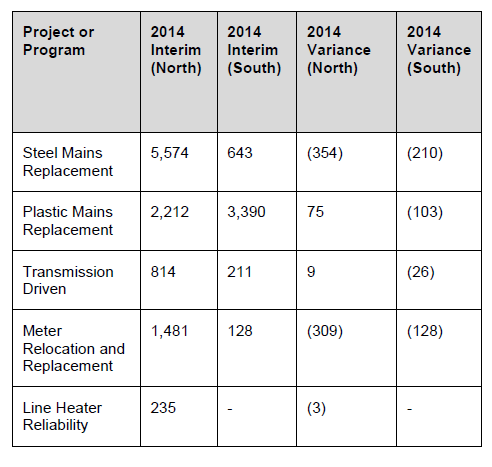

In Decisions 3267-D01-2015 and 20385-D01-2015, the AUC finalized ATCO’s 2013 K Factor true-up and 2014-2015 forecast applications. In those decisions, the AUC approved actual 2013 K Factor amounts of $6.9 million for the northern service area, and $2.7 million for the southern service area, resulting in a 2013 K Factor true-up refund of $9.4 million. The AUC also approved a 2014 K Factor forecast of $13.1 million in the northern service area and $5.9 million in the southern service area, and a 2015 K Factor forecast of $21.0 million in the northern service area, and $11.4 million in the southern service area on an interim basis, pending future true-ups.

ATCO applied for true-ups of the following 2014 K Factor amounts:

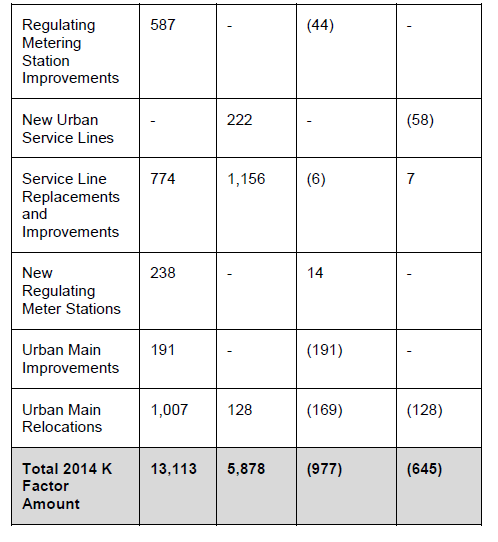

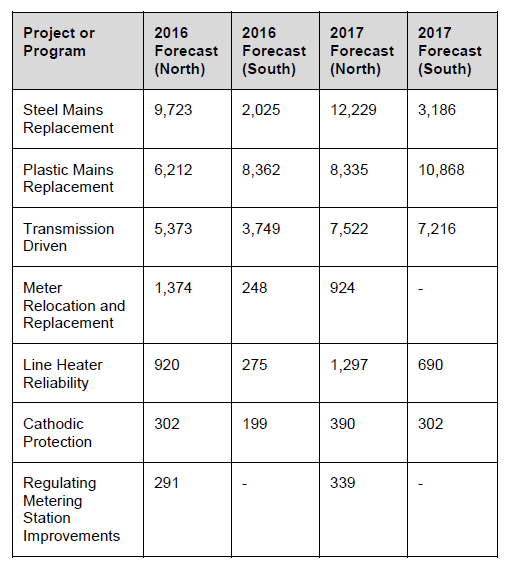

ATCO applied for K Factor treatment for the following projects in 2016 and 2017:

Grouping of Projects

ATCO submitted that it maintained the same project groupings as proposed in its previous capital tracker applications, which were approved in Decision 2013-435 and Decision 3267-D01-2015.

The AUC determined that to the extent the project groupings as applied for are the same as those approved in Decision 2013-435 and Decision 3267-D01-2015, the AUC held that it would not re-evaluate such groupings. The AUC however noted that while it approved the groupings, it also directed that ATCO provided further information in respect of its Regulating Metering Station Improvements, New Regulating Meter Stations, Meter Set Improvements, Meters and Instruments, Regulators and Meter Installations, Urban Main Extensions, and New Urban Service Lines projects. The AUC also requested that ATCO provide an analysis on grouping all metering related projects into a single project.

ATCO explained with respect to the metering projects, that new meter sets are tracked separately from the cost to improve meter sets, because the cost drivers are different. New meters, ATCO submitted, are driven by growth, while improvements are primarily driven by aging assets, replacements and significant changes to customer requirements. ATCO explained that it separated regulating meter and customer meter programs due to the vast difference in cost per unit.

ATCO also explained that it did not group Urban Main Extensions and New Urban Service Lines together, as ATCO considered the nature of the work involved in each project to be significantly different, as service lines are driven by the connection of a single customer, while main lines service all customers.

None of the interveners raised concerns with ATCO’s proposed groupings.

The AUC held that ATCO’s proposed grouping for each of the metering projects was reasonable, given the differing cost drivers and asset types. The AUC therefore approved the project groupings as filed.

Criterion 1 Assessment

The AUC held that it had previously approved all of ATCO’s projects (with the exception of Emergency Supply) in Decision 2013-435 or Decision 3267-D01-2015 as compliant with Criterion 1 on an actual or forecast basis. Accordingly, the AUC held that there was no need to re-assess such projects, as no evidence was presented that would require such a re-assessment.

No objections were raised by any interveners for the following previously approved projects:

-

Line Heater Reliability;

-

Regulating Metering Station Improvements;

-

Service Line Replacements and Improvements;

-

Urban Main Improvements; and

-

Urban Main Relocations.

Accordingly, as the AUC found that no intervener raised any concerns with the above projects, the scope, level and timing of the forecast costs for 2016-2017 were held to be reasonable, and the AUC approved each project as filed. The AUC also found the actual incurred costs for 2014 were prudent, and accordingly approved such costs as filed.

The remaining previously approved projects were also approved as filed, unless otherwise noted.

The Consumers’ Coalition of Alberta (“CCA”) and Utilities Consumer Advocate (“UCA”) raised objections to the Steel Mains Replacement program, as both argued that ATCO had not provided adequate engineering assessments. The CCA also expressed concerns that ATCO relied on a “demerit point” program to assess risks as part of its Steel Mains Replacement program, but did not provide any information with respect to how the demerit point system affected forecast costs. The CCA also expressed concerns about the frequency and classification of gas leaks on ATCO’s system, which the CCA described as unsupported and arbitrary, as the CCA noted that ATCO’s evidence did support a finding that gas leaks were becoming more frequent.

The AUC determined that the demerit point system, to the extent that it affects or changes current forecasts for Steel Mains Replacements, must be tested by the AUC in future proceedings. Therefore the AUC directed ATCO to file its proposed revisions to the demerit point system as part of its 2015 capital tracker true-up application.

The AUC held that the late introduction of the CCA’s concerns regarding leak rates prevented parties from fully exploring the issues on an evidentiary basis. Therefore the AUC held that there was an insufficient basis to reject the Steel Mains Replacement as proposed by ATCO. However, the AUC determined that such additional data would be helpful in future proceedings, and directed ATCO to provide data on the total number of leaks per 100 kilometers on a 2-year and 10-year time period basis.

The AUC held that the scope, level and timing, of forecast costs in 2016 and 2017 were reasonable. The AUC also held that the actual costs for 2014 were reasonable and prudent.

The AUC approved ATCO’s Plastic Mains Replacement project, finding the scope, level and timing of such expenses for 2016 and 2017 to be reasonable. The AUC also approved the 2014 costs as reasonable and prudent. However the AUC raised concerns with respect to ATCO’s forecasting regression models for the Plastic Mains Replacement program, noting a number of discrepancies, and some difficulty in reproducing ATCO’s regression analysis. Consequently, the AUC directed ATCO to re-estimate its regression equations, and to apply these equations to recalculate its 2016 and 2017 costs. Subject to the directions to update its regression analysis, the AUC approved the continuation of the Plastic Mains replacement.

With respect to Transmission Driven Capital forecast costs, the AUC held that the timing for the Palliser and Bridlewood Gate projects, which form part of the Southwest Calgary Connector, were uncertain due to the the fact that no approvals had been requested for the Southwest Calgary Connector Project. Accordingly, the AUC held that there was insufficient evidence to include the forecasted costs for this project in the 2017 forecast of Transmission Driven Capital.

The AUC directed ATCO to update its forecast costs for the New Urban Service Lines, Urban Main Extensions, and Rural Main Extensions and Service Lines projects using the Q4 Canada Mortgage and Housing Corporation report, on the basis of ATCO’s evidence that the forecast costs are highly dependent on larger economic factors. The AUC directed that these forecasts be updated in ATCO’s compliance filing to this decision. The AUC therefore deferred any findings on the scope, level and timing of forecast costs for the New Urban Service Lines, Urban Main Extensions, and Rural Main Extensions and Service Lines projects until ATCO filed its compliance filing, including the updated Q4 forecast from the Canada Mortgage and Housing Corporation.

With respect to the Emergency Supply project, ATCO explained that the purpose of the project was to maintain service to customers in the event of an outage on the distribution system by maintaining mobile compressed natural gas units to respond to emergencies. ATCO explained that a number of its existing mobile units are reaching the end of their useful lives, noting that such assets will need to be replaced in 2016 and 2017.

ATCO forecasted total expenses related to Emergency Supply over the forecast period of $0.4 million, split between both north and south service areas.

The CCA submitted that ATCO’s mobile unit capacities cannot be used for all loss of supply situations, and are only viable for certain limited flow scenarios. The CCA therefore argued that there was insufficient evidence to show that the Emergency Supply project met the Criterion 1 test for capital tracker treatment.

The AUC held that the expenditures under the Emergency Supply program were of sufficient importance to provide service at adequate levels, and that such service may be compromised if such expenditures were not taken. However, the AUC noted that it was concerned with the scope, level and timing of the expenditures. The AUC held that ATCO had not sufficiently demonstrated that the timing of the expenditures were outside the discretion of management and that current service quality could not be maintained through continuing with operating and maintenance levels of spending. Accordingly, the AUC held that it was not prepared to approve the Emergency Supply project for capital tracker treatment, and directed ATCO to remove amounts associated with the Emergency Supply program from its compliance filing. The AUC noted that ATCO may apply for capital tracker treatment of the Emergency Supply program on an actual basis at the time of the 2016-2017 capital tracker true-up applications.

The AUC held that each of the remaining capital tracker projects and programs met the requirements for Criterion 1 and accordingly approved the need, scope, level and timing for each program, either on an actual basis for 2014, or on a forecast basis for 2016 and 2017.

However, since the AUC directed changes to ATCO’s accounting test as it relates to the approved I-X index value and Q Factor values for 2016, the AUC held that it was unable to make a determination as to whether the capital tracker projects met the accounting test under Criterion 1 in its entirety.

The AUC therefore directed ATCO to revise its accounting test in its compliance filing to reflect the approved I-X index value and Q Factor values for 2016 and 2017.

Criterion 2 Assessment

ATCO confirmed that all of the capital tracker projects and programs applied for, both for its 2014 true-up and its 2016-2016 forecast, were previously approved under Criterion 2, and that the cost drivers had not changed since its last application.

With respect to its new capital tracker project, Emergency Supply, ATCO submitted that this project was aimed at asset replacement or refurbishment.

None of the interveners raised any concerns with ATCO’s submissions with respect to Criterion 2.

The AUC noted that for the purposes of the 2014 true-up, and 2016-2017 forecast, there was no need to undertake an assessment of whether the previously approved projects complied with Criterion 2, as they were approved in Decision 3267-D01-2015, and the cost drivers had not changed.

The AUC did not assess Emergency Supply against Criterion 2, as it has already rejected this program for capital tracker treatment under Criterion 1.

Criterion 3 Assessment

Criterion 3 is a two step materiality test which assesses the impact of capital tracker costs at four basis points of total revenue requirement for individual projects or programs, and 40 basis points of total revenue requirement for the total capital tracker costs not covered by the I-X mechanism for the applicable year.

For its 2014 capital tracker true-up, ATCO applied a four basis point threshold of $0.147 million for its northern service area, and $0.121 million for its southern service area. ATCO applied a 40 basis point threshold of $1.47 million for its northern service area and $1.21 million for its southern service area, which it submitted were previously approved in Decision 3267-D01-2015. ATCO also submitted that each 2014 capital tracker project or program satisfied both materiality requirements of Criterion 3.

For 2016-2017, ATCO submitted that it calculated the materiality thresholds consistent with the methodology set out in Decision 2013-435. However, since ATCO did not have approved inflation factors for 2016 or 2017, it used the approved 2015 inflation factor of 1.49 percent for both 2016 and 2017. Accordingly, ATCO calculated its 2016 materiality thresholds as follows:

-

Four basis point threshold: $0.152 million for its northern service area;

-

Four basis point threshold: $0.124 million for its southern service area;

-

40 basis point threshold: $1.52 million for its northern service area; and

-

40 basis point threshold: $1.24 million for its southern service area.

ATCO calculated its 2017 materiality thresholds as follows:

-

Four basis point threshold: $0.154 million for its northern service area;

-

Four basis point threshold: $0.126 million for its southern service area;

-

40 basis point threshold: $1.54 million for its northern service area; and

-

40 basis point threshold: $1.26 million for its southern service area.

None of the interveners to the proceeding took issue with ATCO’s calculations.

The AUC held that ATCO’s calculations and forecasting methods were reasonable. The AUC accordingly approved ATCO’s 2014 threshold values as filed, and confirmed that the 2014 true-up values met the materiality thresholds of Criterion 3 for capital tracker treatment. However, since the filing of ATCO’s application, the AUC provided a final 2016 I-X value of 0.90 percent in Decision 20820-D01-2015. Therefore, the AUC directed ATCO, in its compliance filing, to apply materiality thresholds for Criterion 3 using the approved 2016 I-X factor as a forecast value for both 2016 and 2017.

Order

The AUC approved ATCO’s 2014 K Factor adjustments for its northern service area of $977,000, and for its southern service area of $645,000 as final. The AUC directed ATCO to propose, in its compliance filing, how the difference between its interim and final rates would be refunded to its customers.

The AUC also directed ATCO to propose a method to collect the difference between the respective 2016 and 2017 placeholder amounts and the approved 2016 and 2017 K Factor amounts in its compliance filing.

The AUC therefore directed ATCO to file a compliance filing in accordance with the AUC’s findings and directions made in this decision on or before May 12, 2016.