Water Utility – General Rate Application – Wastewater Utilities not subject to AUC Jurisdiction

In Decision 21340-D01-2017, the AUC considered Horse Creek Water Services Inc.’s (“HCWS”) general rate application requesting approval of its proposed water rates for 2017 and 2018.

Based on the AUC’s determinations regarding operating, maintenance and administration (“OM&A”) expenses, depreciation, and return on owner-invested capital, the AUC directed HCWS to maintain its current rates, effective as of November 1, 2017.

The AUC further directed that HCWS’ interim rates approved in Decision 20663-D01-2015 be deemed as final.

Jurisdiction to Set Waste Water Rates

The intervener group consisting of the Monterra residents and MCL Development Corp. (the “Monterra Group”) submitted that the wastewater system owned by HCWS’ affiliate, Horse Creek Sewer Service (“HCSS”), was also subject to the AUC’s rate-setting jurisdiction.

The AUC did not accept the Monterra Group’s argument that the wastewater system was a “public utility” subject to the AUC’s rates setting jurisdiction, finding as follows:

[T]he Commission is of the view that the definition of “public utility” in the Public Utilities Act deliberately excludes provision of wastewater services, except in relation to the supply by municipal public utilities and regional services commissions on order under Section 122. The Commission does not consider that reading in wastewater or sewage into the definition of “public utility” in Section 1(i) can be justified. Accordingly, the Commission concludes that its jurisdiction to deal with public utilities as provided for in the Public Utilities Act does not generally extend to wastewater utilities.

Tie-in Fees

The AUC approved a tie-in fee of $10,000 per new lot, a reduction from the $16,500 amount applied for by HCWS. However, the AUC stated that this level of the tie-in fee should not continue indefinitely. The AUC found that as HCWS expands its customer base, the revenue shortfall would decline. The AUC directed HCWS to monitor its revenue shortfall on a go-forward basis, and report the shortfall amount to the AUC, on an annual basis, commencing with the 2017 year-end. Based on this information, the AUC stated that it might reconsider the amount of the tie-in fee based on HCWS’ annual reporting.

In addition, the AUC directed HCWS to track the amount it receives from the tie-in fee and whether such amounts are used to offset the revenue deficiency or fund capital expenditures. To the extent that the tie-in fee is used to fund capital expenditures, the AUC directed HCWS to record any amounts received from the tie-in fee as a customer contribution, which would reduce the rate base.

Operator Contract Costs

The AUC approved the operator contract costs applied-for by HCWS, based on the following findings:

-

HCWS’ agreement with Aquatech (the “Operator Contract”) set out the components included in the water treatment plant and distribution system, and provided a contract price for operating the water treatment plant and distribution system; and

-

the Operator Contract did not include any wastewater system assets or the costs for the operation and maintenance of those assets.

With respect to alternative H20 Pro operator contract costs proposed by the Monterra Group, the AUC found that the alternative operator contract costs were not a suitable comparator. Specifically, the AUC found that:

(a) the estimate provided by H2O Pro did not include expenses associated with non-routine services, parts, and subcontractors; and

(b) that this may explain the difference between HCWS forecast expenses and H2O Pro’s estimated costs.

Cross-Subsidization between Water and Sewer

The AUC found that certain expenses included in HCWS’ application represented shared expenses between the HCWS potable water system and the HCSS wastewater system. Specifically, the AUC found the following reductions in HCWS’ applied-for OM&A expenses to be warranted:

(a) a reduction in its forecast electricity expenses by $4,800 per year; and

(b) a reduction in its insurance expense of $4,026 per year.

Rate Base

The AUC found that HCWS’ purchase of the combined water and wastewater assets was contingent upon it assuming the liability with Rocky View County (“RVC”). On this basis, the AUC found that the total purchase price for the assets to be $1,630,855 ($1,039,999 + $590,856).

Return on Rate Base

In considering the amount of return that HCWS should be allowed to collect as part of its revenue requirement, the AUC explained that there are three components used to determine the return amount:

(a) the return on equity (“ROE”);

(b) the cost of debt; and

(c) capital structure (debt/equity ratio).

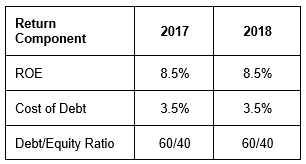

The following table provides a summary of values for each component the AUC approved for HCWS:

The AUC explained that capital structure is the percentage of the company financed by debt versus the percentage of the company financed by equity, also known as the debt/equity ratio. In approving a debt/equity ratio of 60/40, the AUC found that:

(a) HCWS would not likely be able to obtain as favourable financing rates as large utilities; and

(b) approving a debt/equity ratio of 60/40, as compared to 75/25 recommended by the Monterra Group, balanced the lower debt return awarded to HCWS relative to the industry average.

The AUC directed HCWS to apply the deemed capital structure of 60 percent debt and 40 percent equity, to its current capital structure.