Rates – Performance Based Regulation (PBR) – Electricity/Gas Distribution – Next Generation PBR – Parameters

In Decision 20414-D01-2016 (the “2016 PBR Decision”), the AUC determined the parameters that apply to the next generation of performance based regulation (“PBR”) plans. The parameters the AUC approved in the decision apply for the 2018-2022 PBR term.

The 2016 PBR Decision applies to the following electricity and gas distribution utilties:

• ATCO Electric Ltd.;

• ENMAX Power Corporation (“ENMAX”);

• EPCOR Distribution & Transmission Inc.;

• FortisAlberta Inc.;

• AltaGas Utilities Inc.; and

• ATCO Gas and Pipelines Ltd.;

(collectively, the “PBR Utilities”).

However, due to ENMAX being subject to an individual incentive based regulation plan, certain AUC holdings were individualized to ENMAX’s unique plan. Those differences are not discussed in this summary.

PBR Plan Overview

The 2016 PBR Decision did not alter the general PBR framework, as set out in AUC Decision 2012-237 (the “2013 PBR Decision”).

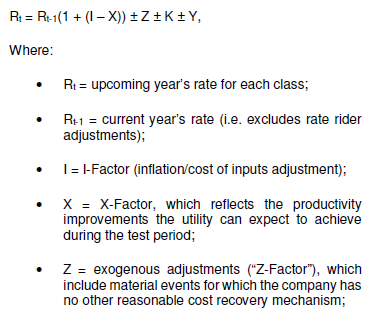

The PBR framework approved in the 2013 PBR Decision provides for annual rates adjustments based on an indexing mechanism (the “I-X Mechanism”) that tracks the rate of inflation (“I Factor”) less a productivity offset (“X-Factor”).

The I-Factor is designed to represent the expected increase in the price of inputs and therefore a positive I-Factor results in higher rates. However, the I-Factor is offset by the XFactor, which represents the expected efficiency improvements the PBR Utilities are expected to achieve during the PBR plan period.

The I-X Mechanism results in severing the link between a utility’s costs of service (“COS”) and the revenue it receives in rates, for the term of the applicable PBR plan. The objective of PBR is to incent utilities to maximize their returns by improving efficiency, rather than by increasing their COS, as may be the case under traditional COS regulation.

The rate setting mechanism set out in the 2013 PBR Decision is expressed by the following formula:

The I-Factor approved in the 2013 PBR Decision was continued unchanged in the 2016 PBR Decision. The IFactor continues to be determined by the formula:

Scope of 2016 PBR Decision and Significant Holdings

In the 2016 PBR Decision, the AUC limited the scope of the proceeding to consideration of four PBR plan parameters, namely:

1. rebasing and the going-in rates for the next generation PBR term (2018-2022),

2. the X-Factor,

3. the treatment of capital additions (previously, the KFactor), and

4. the calculation of the return on equity (“ROE”) for reopener purposes.

Significant changes approved in the 2016 PBR Decision for the next generation of PBR plans include:

• a requirement that going-in rates be based on actual costs experienced in the previous term and not on forecasted costs for the next term;

• a determination that the X-Factor (inclusive of a productivity growth and stretch factor) will be equal to 0.3 percent for the next PBR term, a reduction from the 1.16 percent approved in the 2013 PBR Decision; and

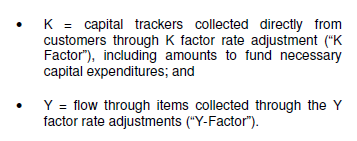

• changes to the capital funding mechanism, whereby most capital additions will be funded through a mechanism tied to the I-X Mechanism (the K-bar parameter) rather than being COS based, as is the case for the K-Factor.

A more detailed summary of the AUC’s findings is provided below.

Rebasing and Going-in Rates

The AUC directed that going-in rates be based on actual costs experienced during the current generation PBR term, with any necessary adjustments to reflect individual utility’s circumstances.

The AUC rejected the use of forecasted costs in determining PBR going-in rates noting that:

a) setting going-in rates based on forecast costs may create incentives to over-forecast, limiting potential benefits to customers from PBR plan re-basing; and

b) testing cost forecasts would require the same level of detail as in traditional COS proceedings, contrary to the purpose of PBR to improve efficiency and reduce regulatory burden.

The AUC directed each of the Affected Utilities to file by March 31, 2017, an application to determine a notional 2017 revenue requirement, on which going-in rates are to be based (“Going-in Rates Application(s)”).

The AUC directed that such an application calculates the going-in rate base based on the average actual capital additions for years of the current generation PBR plans, excluding the last year, restated to 2017 dollars.

Specifically, a Going-in Rates Application’s proposed notional rate base must:

a) use the actual 2016 closing rate base, as the starting point;

b) adjust the rate base by removing utility assets as directed in prior asset disposition decisions;

c) add to the 2016 closing rate base, the average actual capital additions for years 2013 to 2016;

d) for the capital tracker component, add the approved 2017 forecast capital tracker capital additions to the 2016 closing rate base; and

e) apply 2017 depreciation using the distribution utility’s most recent approved depreciation methodologies applied to notional rate base as determined in (a)-(d).

The AUC further directed that the O&M part of the revenue requirement be based on the lowest actual annual O&M expenditures experienced during the 2013-2017 PBR term. The AUC approved the use of a Q-factor, which allows for adjustments to O&M expenses due to customer growth.

Phase II applications will be accepted for consideration sometime following the commencement of the next generation PBR plans. Any changes to rates approved in Phase II applications – e.g. requesting the AUC consider a new COS or depreciation study – will only apply on a prospective basis.

Efficiency Carry-over Mechanism

The AUC noted that a utility’s incentive to find efficiencies weakens as a PBR term nears an end, unless there is an efficiency carry-over mechanism (“ECM”). An ECM seeks to incent late term efficiency improvements by providing an associated financial “reward” carried-over into the subsequent PBR term.

In the 2013 PBR Decision, the AUC approved an ECM that functions as on add-on to an approved ROE for an applicable year. Specifically, the approved ECM is ROEbased, equal to one half the difference between a utility’s average actual ROE achieved over the 2013-2017 PBR term and the average approved ROE over that term.

In this 2016 PBR Decision, the AUC adopted EPCOR’s proposal whereby the ECM ROE add-on is applied to the 2017 mid-year rate base, and escalated by the approved IX value for each of the subsequent years 2018 and 2019.

X-Factor: Total Factor Productivity (TFP) Growth and Stretch Factor

The X-Factor is comprised of two components:

1. a total factor productivity growth (“TFP”) factor, representing average rate of long term productivity growth in the industry; and

2. a stretch factor, which is an additional percentage included in the X-Factor which slows the revenue cap growth under the I-X Mechanism. A stretch factor can be viewed as sharing with customers the expected cost reductions resulting from the transition from COS to PBR.

With respect to TFP growth, the AUC considered evidence and estimations of such values from various experts.

The AUC noted the considerable variability in the experts’ estimates, resulting from the variation in choice of assumptions employed in each expert model. The AUC concluded, that based on such evidence, the TFP growth factor falls within a reasonable range of values, between – 0.79 and +0.75.

The AUC held that a reasonable X factor for the next generation PBR plans for the PBR Utilities, inclusive of a stretch factor, is 0.3 per cent.

The AUC did not adopt the UCA’s proposal to restrict the IX Mechanism to being non-negative. The AUC noted that such an approach may result in weaker incentives to control costs for certain categories of expenditures.

Type 1 Capital Projects

The AUC approved a capital funding mechanism whereby capital projects are categorized as either Type 1 or Type 2.

Type 1 capital trackers, which replace the original capital tracker criteria established in AUC Decision 2013-435 (KFactor treatment criteria), require a project to be:

(i) of a type that is extraordinary and not previously included in the distribution utility’s rate base; and

(i) required by a third party, (the “Type 1 Project Criteria”).

The placeholder for Type 1 projects or programs will be calculated as 90 per cent of the management-approved internal forecast for that year. This forecast will not be tested for reasonableness because the prudence of such amounts will be considered in Type 1 capital tracker trueup applications.

Type 2 Capital Projects and K-Bar Parameter

Type 2 capital projects are all other capital additions that do not meeting the Type 1 Project Criteria.

For Type 2 capital additions, the AUC directed an initial Kbar capital factor (“K0”) would be established as the incremental capital funding for all Type 2 capital in 2018. The base K-bar would be calculated by using an accounting test similar in concept to the test used during the 2013-2017 PBR term, represented by following formula:

Calculation of ROE for the Re-opener Threshold

The AUC held that it will continue to utilize an allowed ROE for a given year as the “base” ROE. The base ROE will be equal to the approved ROE as determined in a generic cost of capital proceeding (see above for summary of 2016 GCC Decision summary).

That base ROE is to be compared against a utility’s actual return to determine the applicable reopener value for that year.

The AUC held that it will employ a +/-500 basis point threshold for a single year and +/-300 basis point threshold for two consecutive years as warranting consideration of a reopening and review of a PBR plan.