Rebasing Applications – Distribution Utilities

In this decision, the AUC considered the second compliance filing for the interim notional 2017 revenue requirement and 2018 base K-bar for the 2018-2022 performance-based regulation (“PBR”) plans for the following Alberta electric and gas distribution utilities:

-

AltaGas Utilities Inc.,

-

ATCO Electric Ltd. (distribution),

-

ATCO Gas and Pipelines Ltd. (distribution),

-

ENMAX Power Corporation (distribution) (“ENMAX”),

-

EPCOR Distribution & Transmission Inc. (distribution) (“EPCOR”), and

-

FortisAlberta Inc. (“Fortis”)

(collectively, the “Distribution Utilities”).

While the AUC accepted the general principles and methodologies utilized by each of the Distribution Utilities for calculating their respective 2018 PBR rates, the AUC did not approve any specific rates in this decision since the directions throughout this and other decisions would result in changes to 2018 rates.

The AUC directed each of the Distribution Utilities to file an update in its 2019 annual PBR rate adjustment filing, providing the 2018 rate schedules and incorporating the directions in this decision. The AUC further directed the Distribution Utilities to update their respective 2019 PBR rates, as required.

Background

The PBR framework provides for annual rates adjustments based on an indexing mechanism that tracks the rate of inflation (“I”) less a productivity offset (“X”) factor, referred to as the I-X factor.

The I-X factor represents the expected increase in the price of inputs, I, offset by the X factor, which represents the expected efficiency improvements the Distribution Utilities are expected to achieve during the PBR plan period.

The I-X mechanism is intended to sever the link between a utility’s costs of service (“COS”) and the revenue it receives in rates, for the term of the applicable PBR plan. The objective of PBR is to incent utilities to maximize their returns by improving efficiency, rather than by increasing their COS, as may be the case under traditional COS regulation.

2018-2022 PBR Plans Decision

In Decision 20414-D01-2016 (Errata) the (“2018-2022 PBR Plans Decision”), the AUC set out the parameters of the 2018-2022 PBR plans for the Distribution Utilities.

In the 2018-2022 PBR Plans Decision, the AUC determined that the going-in rates would be based on a notional 2017 revenue requirement developed using actual, pre-2017 costs that the Distribution Utilities incurred during the years of the preceding 2013-2017 PBR plan (2015-2017 for ENMAX), with any necessary adjustments to reflect individual utility anomalies. The AUC also approved the methodology for determining the components of the 2017 notional revenue, including the following:

(a) the operating and maintenance (“O&M”) cost component based on the utility’s lowest O&M cost year in the preceding PBR term, restated to 2017 dollars using the approved I-X and Q values; and

(b) the capital component of the notional 2017 revenue requirement calculated using the 2016 actual closing rate base and adding the 2017 capital additions, split between capital additions that were covered by the I-X mechanism in 2017 and those that were subject to capital tracker treatment in 2017:

(i) for capital additions covered by the I-X, the AUC directed parties to use the four-year average of 2013-2016 actual capital additions (2015-2016 additions for ENMAX) restated to 2017 dollars using the approved I-X and Q values; and

(ii) for capital additions subject to capital tracker treatment, the actual approved capital additions were to be used.

Continued from prior generation PBR plans, the AUC designated the forecast percentage change in billing determinants in any given PBR year as “Q.”

The AUC explained that multiplying the going-in revenue requirement for similar types of expenditures by the I-X index and adjusting for Q resulted in a proportional allocation of the impact on revenue of any changes in billing determinants. For electric Distribution Utilities under the price cap PBR plan, this percentage change was calculated across all billing determinants, including energy, demand, and the number of customers. For gas Distribution Utilities under the revenue-per-customer cap PBR plan, the percentage change was calculated as a forecast weighted-average change in the number of customers among rate classes.

Significant changes approved in the 2018-2022 PBR Plans Decision from the previous generation of PBR plans included the following:

(a) a requirement that going-in rates be based on actual costs experienced in the previous term and not on forecasted costs for the next term;

(b) a determination that the X Factor (inclusive of a productivity growth and stretch factor) would be equal to 0.3 percent for the next PBR term, a reduction from the previously approved 1.16 percent; and

(c) changes to the capital funding mechanism, whereby most capital additions would be funded through a mechanism tied to the I-X Mechanism (the K-bar parameter) rather than being COS based, as was the case for capital projects eligible for capital tracker treatment under the previous generation of PBR plans.

First Compliance Filing

The AUC subsequently issued Decision 22394-D01-2018 dealing with the first compliance proceeding (the “First Compliance Decision”), pursuant to the AUC’s directions in the 2018-2022 PBR Plans Decision.

In the First Compliance Decision, the AUC made directions to the Distribution Utilities requiring modification to various components of the notional 2017 revenue requirement and base K-bar amount. The AUC directed each of the Distribution Utilities to file a second compliance application reflecting the directed modifications.

Summary of AUC Findings re Second Compliance Filing

In this second compliance filing decision, the AUC found the applied-for notional 2017 revenue requirement and 2018 base K-bar amounts generally to be in alignment with the AUC’s directions in the 2018-2022 PBR Plans Decision and the First Compliance Decision.

For the 2018 base K-bar calculations, the AUC approved the Distribution Utilities using the parameters approved in Decision 22570-D01-2018 (the “2018 Generic Cost of Capital Decision”), namely:

(a) return on equity (“ROE”) of 8.5 percent; and

(b) a deemed equity ratio of 37 percent for all the Distribution Utilities, other than AltaGas, for which the AUC approved a deemed equity ratio of 39 percent.

2018 I Factor and the Resulting I-X Index for 2018

The AUC approved the 2018 I factor of 0.10 percent and the resulting I-X index value of negative 0.20 percent for 2018.

For 2018, the AUC found that all Distribution Utilities followed the approved methodology and calculated an inflation factor of 0.10 percent for use in their 2018 PBR rate adjustment formulas. Together with the X factor of 0.30 percent approved in the 2018-2022 PBR Plans Decision, this I factor resulted in an I-X index of negative 0.20 percent for 2018.

The AUC found the Distribution Utilities’ calculations of the 2018 I factor to be consistent with the methodology confirmed in the 2018-2022 PBR Plans Decision. The AUC also verified that the Distribution Utilities used the correct Statistics Canada data from the prior year’s I factor filing as the basis for this year’s I factor calculations.

2018 Interim Efficiency Carryover Mechanism Amounts

The AUC previously approved an efficiency carryover mechanism (“ECM”) to encourage the Distribution Utilities to continue to make cost-saving investments near the end of the PBR term and discourage gaming regarding the timing of capital projects. Only the Distribution Utilities that were on the 2013-2017 PBR plans included the ECM amounts in their 2018 PBR rates.

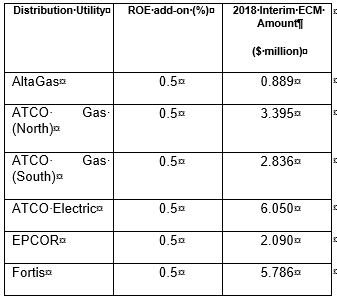

The AUC found that in their second compliance applications, the Distribution Utilities calculated their respective 2018 interim ECM dollar amounts in accordance with AUC directions in the amounts shown in the table below:

Table: 2018 Interim ECM Amounts

The AUC found that the two non-tax-paying Distribution Utilities, EPCOR and Fortis, calculated their respective 2018 interim ECM amounts in accordance with the AUC’s direction.

The AUC was satisfied with how the three tax-paying Distribution Utilities calculated their respective 2018 interim ECM amounts, finding that it was reasonable:

(a) for the tax-paying utilities to gross up the ECM amounts for income tax because they would have to pay tax on any revenue received from the ECM and that the ROE used in the calculation represented an after-tax amount; and

(b) for AltaGas to use weather-adjusted ROE in its ECM calculation, since AltaGas did not have a weather deferral account.

The AUC approved the interim 2018 ECM amounts shown in the table above. These ECM amounts would be finalized following the determination of final notional 2017 mid-year rate base amounts.

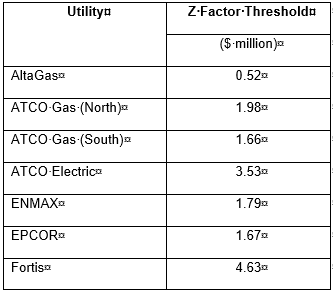

Z Factor Materiality Threshold

The Z factor allows for an adjustment to a distribution utility’s rates in order to account for a significant financial effect from an exogenous event and for which the distribution utility had no other reasonable opportunity to recover the costs under the PBR formula.

The AUC was satisfied with the Z factor threshold calculations for the Distribution Utilities as set out in the table below.

The AUC found that the calculated threshold amounts shown above were consistent with the methodology prescribed by the AUC in the 2018-2022 PBR Plans Decision and, accordingly, approved these Z factor threshold amounts.

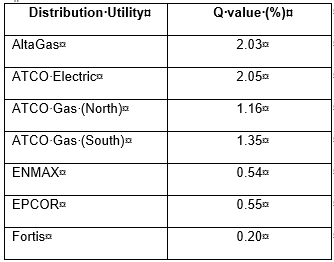

2018 Q

The AUC confirmed the use of previously approved forecast (for EPCOR) and approved the forecast (for all other Distribution Utilities) billing determinants for 2018 on which the Q values were calculated. The AUC approved the 2018 Q values for each Distribution Utility as shown in the table below.

Going-In Rates and 2018 PBR Rates

The Distribution Utilities calculated their going-in rates based on the notional 2017 revenue requirement. To arrive at the 2018 PBR rates, the Distribution Utilities escalated the going-in rates by the 2018 I-X index of negative 0.2 percent and applied the 2018 K-bar and Y factors.

The AUC accepted the general principles and methodologies utilized by each of the Distribution Utilities for calculating their respective 2018 PBR rates. However, the AUC did not approve any specific rates in this decision, given the AUC’s directions regarding the notional 2017 revenue requirement, 2018 base K-bar and Y factors.

Y Factor

Y factor costs are costs that are flowed through to customers. The AUC found that the applied-for Y factor true-up adjustments were adequately supported and properly calculated. The AUC also found the forecasting methodologies provided in the applications and supporting information provided in information request responses were reasonable and consistent with the methodologies used in previous PBR annual filings.

The AUC directed each of the tax-paying utilities to confirm whether and when it planned to apply for any adjustments associated with the removal of the Y factor for tax timing differences, in accordance with provisions of the 2018 Generic Cost of Capital Decision.

Utilization of Riders

The AUC approved the continuation of the Distribution Utilities’ previously approved riders.

The AUC found that these riders were necessary to address flow-through or AUC directed items (i.e., items relating to Y factors) approved for inclusion in the Distribution Utilities’ 2018-2022 PBR plans.

Summary

The AUC did not approve any specific rates in this decision since the AUC’s directions throughout this and other decisions would result in changes to 2018 rates. However, the AUC accepted the general principles and methodologies utilized by each of the Distribution Utilities for calculating its 2018 PBR rates.

The AUC directed each of the Distribution Utilities to file an update in its 2019 annual PBR rate adjustment filing, providing the 2018 rate schedules and incorporating the directions in this decision. The AUC further directed the Distribution Utilities to update their 2019 PBR rates, as required.